Forex news for Asia trading Monday 14 January 2020

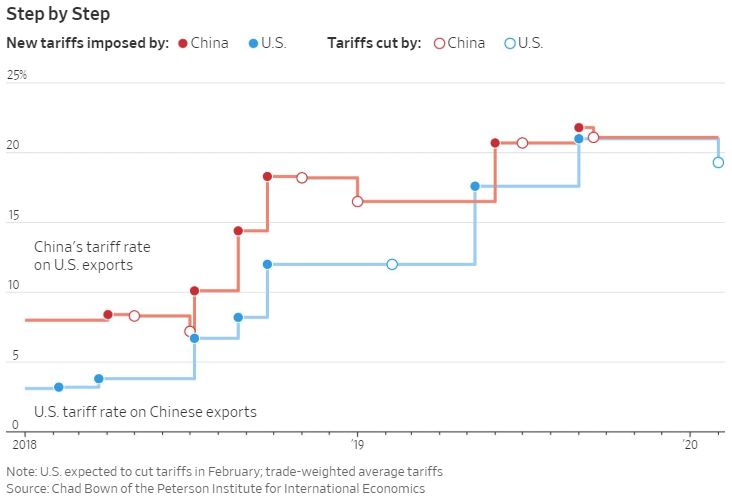

- Here's how much the phase 1 trade deal will reduce US/China tariffs (spoiler - barely any reduction at all)

- FT: Why the Japanese yen is not the haven asset it once was

- Hong Kong Economic Times says HK to announce more stimulus measures today

- China December trade balance in USD terms out now, exports +7.6% y/y

- Former chair of the Federal Reserve Yellen says the US trade war with China is far from over

- Chinese Vice Premier Liu He (chief trade negotiator) arrived in Washington Monday

- China official says US not labelling China a currency manipulator positive for trade

- Canada's PM Trudeau says 176 people killed in plane over Iran would be alive if tensions had not escalated

- New 110-115 range for USD/JPY targetted

- Comments from China customs after the trade data - positive US-China sentiment helped

- China December trade data shows exports rise 9% y/y

- 3 reasons to doubt the PBOC will allow the yuan to strengthen much further

- PBOC sets USD/ CNY reference rate for today at 6.8954 (vs. yesterday at 6.9263)

- FX option expiries for Tuesday January 14 at the 10am NY cut

- Here's a heads up for ugly retail sales data to come from Australia

- US, Japan and EU to meet on Tuesday to discuss China's trade polices

- Reports China to buy more US energy, manufactured goods in trade deal

- US Trade Representative Lighthizer - we are about finished on the translation of the trade deal

- Happy Birthday to the Reserve Bank of Australia

- Japan data - current account (Nov) and bank lending (Dec)

- China released car sales figures - market shrank for the second year in a row

- Australia weekly consumer sentiment 107.3 (prior 106.2)

- US Treasury removes China from list of currency manipulators

- Trade ideas thread - Tuesday 14 January 2020

- New Zealand Building approvals for November: -8.5% m/m (prior -1.1%)

- Outlook for Australia in 2020: slow GDP growth, slow wage growth, no lower jobless rate

The US Treasury semi-annual currency manipulator list was published in the early hours of Asia. After including China as a manipulator in August the Treasury removed the country this time around. Ahead of the phase 1 trade deal to be signed on Wednesday. Group hug!

To be fair the inclusion of China on the list last year was ... a stretch ... but the grovelling removal today at least rights that. It also removes any last shred of credibility the US Treasury report had, so there is that. Please excuse my contempt for the once credible institution.

The most notable news item of the day was a report in Politico outlining the terms of the upcoming trade deal (see bullets above). On the data front we got the December trade balance from China which showed a surge in exports and an even greater surge in imports. If the data is to be believed (why wouldn't it be?) its a huge (positive) shock result and augers well for 'risk'.

Major FX ranges were not large but we had a notable move in USD/JPY, above 110 for the first time since May of 2019 and its managed so far to sit above there as I post. AUD and NZD (against the USD) drifted sideways before losing some ground and then recovering to be net barely changed on the session. EUR, GBP and CHF are llittle changed also. Gold lost more on the session following a poor overnight effort.

I posted this earlier, but ICYMI - how the tariffs will reduce under the phase 1 trade deal (you may have to look really closely):