Forex news for Asia trading Friday 15 February 2019

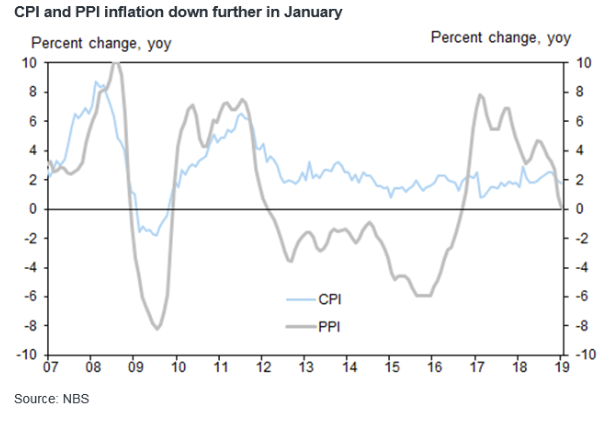

- China inflation (January): CPI 1.7% y/y (expected 1.9%), PPI 0.1% y/y (expected 0.3%)

- PBOC sets USD/ CNY central rate at 6.7623 (vs. yesterday at 6.7744)

- MS on the yuan, says market is underestimating the extent of the coming China rebound

- UK govt watering down request for changes to “backstop” in Brexit deal

- New Zealand seafood exporter shipments delayed at China ports

- Reuters poll shows Federal Reserve expected to hike rates again this year

- China - estimate 65m urban residences (21.4% of housing) unoccupied (up from 18.4% in 2011)

- Will Spain call a snap election this weekend? (Or even sooner?)

- Morgan Stanley on the EUR/USD and the 1.12 struggle

- Trade ideas thread - Friday 15 February 2019

- New Zealand January manufacturing PMI drops to 53.1, from Dec. 55.1

- RBA Assistant Governor Kent spoke on the Australian dollar, economy, monetary policy

The headline to this post was the theme of the day. There are a number of 'risk' events on the horizon later today, on Friday and into the weekend:

- US - China trade talks continued in Beijing, with no fresh news nor gossip as of yet. The latest was overnight, where the take was less than optimistic.

- US President Trump is expected to sign the bill keeping the US government open, but also to declare a national emergency to secure border wall funding

- Brexit ... which never goes away. The latest on this front is talk of the UK government softening its backstop demands with the EU, which of course will open ructions within PM May's party.

With all this going on heading into the weekend yen managed to add a little more gain during the session here. USD/JPY dropped to circa 110.30, slightly extending its overnight loss. EUR is a little weaker against the USD (not more than a few spreads.

NZD slid early, not helped by a trade niggle with China (NZ exports held up at a Chinese port, see bullets above). AUD was down a few points alongside. NZD/USD has managed to show a bit of a recovery. Ranges for both have not been large.

Cable is little net altered on the day. USD/CAD is a few tics higher.

-

Chinese inflation data released today for January has PPI edging back towards deflation (see bullets above) :

(Goldman Sachs graph)

Still to come: