Forex news for Asia trading for Monday 16 November 2020

- NZ PM Ardern announce compulsory mask order on all flights, Auckland public transport

- China data shows new jobs created from Jan to Oct, reached the annual target ahead of schedule

- Chinese military researchers continuing to use US software despite US restrictions

- NZD - risk of further gains is mounting - support, resistance levels ahead

- China activity data for October. IP 6.9% (vs. expected 6.7%) Retail sales 4.3% y/y (expected 5.0%)

- Coronavirus - More on Germany's 'lockdown light' about to turn much tighter

- China October home prices +0.15% m/m (from +0.35% prior)

- PBOC conducts a 1-year MLF

- PBOC sets USD/ CNY reference rate for today at 6.6048 (vs. Friday at 6.6285 )

- FX option expiries for Monday November 16 at the 10am NY cut

- China urges the US to stop its unreasonable suppression of Chinese companies

- Japan economy minister Nishimura says economy continues to pick up after bottom in April

- Australian stock exchange has suspended trading - cites a data issue

- Johnson & Johnson is launching a UK trial of its experimental Covid-19 vaccine

- UK data - Rightmove house prices for November -0.5% m/m (prior 1.1%)

- Japan GDP preliminary for Q3. GDP (sa) 5.0% q/q (vs. expected 4.4%)

- Michigan announces tighter coronavirus restrictions

- Coronavirus - Australian state border reclosed after hotspot flare-up

- AUD traders heads up - RBA Gov Lowe speaking later Monday (0840GMT)

- Coronavirus - Germany appears set to announce stricter lockdown measures on Monday

- Trump tweets will soon file court cases on "the outrage of things that were done"

- Japan to hold emergency talks on coronavirus rising infection numbers

- Trump will enact a series of hardline policies on China during his final weeks

- China to begin large-scale oil and gas project in the South China Sea

- Trade ideas thread - Monday 16 November 2020

- Qualcomm receives US permission to sell 4G chips to Huawei

- Coronavirus weekend news: China-developed vaccine to enter late-stage trial

- New Zealand services PMI for October 51.4 (prior 50.3)

- Economic calendar due from Asia today - China activity data due

- Monday morning open levels - indicative forex prices - 16 November 2020

- Nearly one-third of the world's population signs free trade agreement

- Brexit talks likely to extend beyond this week

- FOMC meet December 15 & 16 - some Fed watchers say the Bank could ease further before this meeting

- Former Fed Chair Janet Yellen is under consideration to be Biden’s Treasury secretary

Before the wrap up of today's events a heads-up to what is likely to be ahead for the US on COVID-19. Cases continue to climb at an increasing rate (expect the next couple of days to be the usual weekend under-count mirage but by mid-week the numbers will be horrendous again), as do, inexorably, hospitalisations. There is a just under a two-week gap between rising cases and rising hospitalisations. The new 1.5 million cases from the last two weeks are about to overwhelm the US health system. Oklahoma reported their ICU capacity is now occupied fully, 100%. Other states will follow in the coming days. For the week ahead, this week, another million cases will be added. The following week will add another million (and more, most likely, given the accelerating trend).

While treatment has improved since the first wave, resulting in a lower death rate, this assumes a case can be admitted to hospital. And that there are healthcare professionals available to treat the ill. Deaths follow hospitalisations by about another two weeks. There is a jam-packed pipeline. The week's ahead look ominous.

For the economy there will be further impacts coming soon. Michigan announced today a tightening of restrictions, other states will follow in the hours and days ahead.

---

OK, back to the wrap-up. Weekend news saw the usual Brexit-related headlines with domestic UK politics thrown into the mix. Hard-line Brexiteer Dominic Cumming was dumped by UK PM Johnson which may indicate some softening from Johnson is to come. Trade talks are still bogged down and talk is they'll go on longer than was planned. A (likely minor) complication is Johnson is in isolation having had contact with a positive person (a coronavirus-positive person that is).

Also on trade, Asia Pacific nations signed RCEP, a comprehensive FTA - it covers China, Japan, South Korea, Australia, New Zealand and many others (15 nations in total). Despite its Pacific coast, the US is not included.

On the data front today we got reasonably good 'activity' data from China for October.

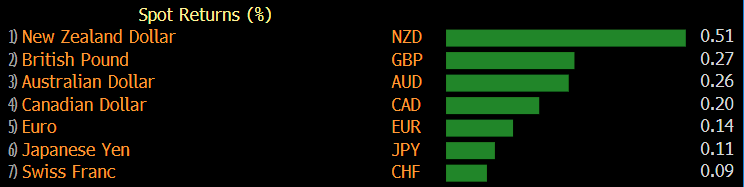

For markets it was a positive sentiment session, US Equity index futures rallied on the reopen for the week and the USD gave back some ground on the upbeat mood. EUR, GBP, AUD, NZD all gained with havens USD, JPY and CHF lagging.