Forex news for Asia trading for Monday 2 November 2020

- NBC says the White House will have a 'non-scalable' wall built around it for election day

- The HK dollar has lost some ground today - HKMA sees no need to adjust USD peg

- RBC says gold should get a boost from possible post-election turmoil

- RBA November monetary policy meeting decision due Tuesday 3rd - preview

- Australian monthly inflation guide for October, headline -0.1% m/m (prior +0.1%)

- Standard Chartered says regardless of who wins the US election strains with China to remain

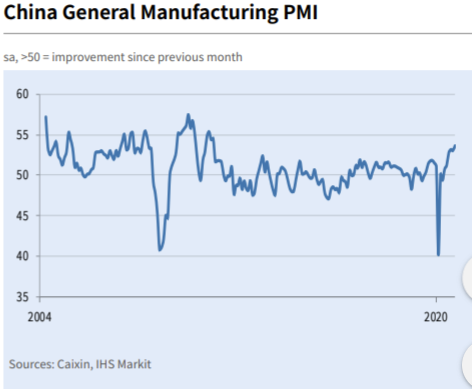

- China October Caixin / Markit manufacturing PMI 53.6 (vs. expected 52.8)

- Bank of Korea Governor says will act to stabilise markets if needed

- Here is why you can't rely on election forecasts (you really can't)

- PBOC sets USD/ CNY reference rate for today at 6.7050 (vs. Friday at 6.7232)

- FX option expiries for Monday November 02 at the 10am NY cut

- Japan October final manufacturing PMI 48.7 (flash was 48.0, prior 47.7)

- Australian building approvals data +15.4% m/m (expected +1.5%)

- Australia - AiG Manufacturing PMI for October 56.3 (prior 46.7)

- New Zealand data - September building permits +3.6% m/m (prior +0.3%)

- CAD is dropping alongside oil in Asia trade Monday

- UK's Prince William contracted COVID-19 in April

- The Reserve Bank of Australia is considering use of a digital currency

- Coronavirus - The new UK lockdown could extend in 2021

- Coronavirus - UK PM Johnson repeats that there is no alternative to lockdown

- Fauci warns that the US 'could not possibly be positioned more poorly' on coronavirus

- US election latest Florida state poll has Biden 6 points ahead of Trump

- Australia's 2nd manufacturing PMI for October 54.2 (same as prior, also 54.2)

- UK coronavirus - Farage to relaunch Brexit Party as anti-lockdown party

- UK health regulator has started an accelerated review of potential coronavirus vaccine AstraZeneca

- Updating the latest market (betting odds) on the US election: Biden 64, Trump 35

- Brexit weekend recap - expecting an encouraging progress report

- Monday morning open levels - indicative forex prices - 2 November 2020

- Brexit trade talks to continue from Monday

Weekend

- UK will extend its wage covering scheme during the new coronavirus lockdown

- Coronavirus - UK PM Johnson to announce a new lockdown, through to until December 2

- November central bank overview

- China official PMIs for October: Manufacturing 51.4 (vs expected 51.3) Services 56.2 (expected 56.0)

GBP opened lower early here in Asia with weekend news that UK PM Boris Johnson had relented and ordered a nationwide lock down. You'll recall that for months Johnson was adamant he would not do so. Johnson cited the mounting new daily case count and said the new restrictions, to be in place until December 2 would help stop health services from getting overwhelmed. The move in the UK follows similar nationwide measure announced in France and Germany last week.

There are more details on the new UK measures in the bullets above.

GBP had a minor retracement move in the hours that followed, not the entire drop though and as I update the moves have run out of what little impetus they had and it sits circa 1.2930.

While on the UK we had some positive inlklings out of Brexit trade talks - these are set to continue this week with some progress being reported on the fishing issue but its not all smooth sailing with points of difference remaining elsewhere also.

When US Sunday evening futures opened oil gapped lower, demand destruction concerns on these accelerating lockdowns around the globe (excluding Asia where the pandemic is largely controlled to small numbers only). The lower oil price bled over into a weaker CAD, USD/CAD gained towards 1.3370 before giving a portion of its upmove back.

US equity index futures lost some ground but have recovered and some.

China's Official PMIs were released over the weekend, all steadily in expansion. The private survey manufacturing PMI was released on Monday, its close to a decade high (graph below).

As I post the net changes for most currencies against the dollar are of miinor degrees only from late Friday levels/ There is a sense of waiting now for the US election although I suspect there are still pre-election moves to come in the Europe and US sessions over the next two days.