Forex news for Asia trading for Wednesday 20 January 2021

- Chinese authorities step up efforts to convince to "stay put" over Lunar New Year

- Impeachment proceedings against Trump are bubbling away still - Pelosi to send articles to the Senate ‘soon’

- Chinese state media says President Xi wants further high-speed rail development

- China's foreign ministry says it strongly opposes US statements on Xinjiang

- Bank of England Governor Bailey speaking Wednesday, 1700GMT

- US President Inauguration timings for Wednesday 20 January 2021

- Volkswagen says expects car market sales in China to exceed 2019 levels

- China MOFCOM professor says CNY is likely to weaken to 6.5-6.8 against USD this year

- Foreign direct investment (FDI) into the Chinese mainland hit a record high in 2020

- China Loan Prime Rate setting: 1 year 3.85%, 5 year 4.65%. Unchanged and as expected.

- The first RBA meeting of the year coming in February - early preview

- PBOC sets USD/ CNY reference rate for today at 6.4836 (vs. yesterday at 6.4883)

- FX option expiries for Wednesday January 20 at the 10am NY cut

- Canada PM Trudeau is using all channels to convey his concern to Biden over Keystone

- UBS on how Bitcoin can go all the way back to zero

- More on the ECB capping bond yields

- Biden US President on Wednesday - what to watch in the hours that follow

- Bloomberg reports that the ECB is pursuing a strategy of yield spread control

- Australia - Westpac consumer confidence for January -4.5% m/m (prior +4.1%)

- Trade ideas thread - Wednesday 20 January 2021

- Italy's government has survived another day

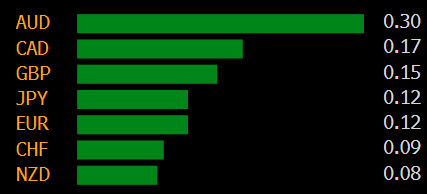

Another session of slow and little-impactful news in Asia but nevertheless small movement for currencies against the USD. Currencies are broadly stronger, although ranges are not large.

Euro is up against the USD but has been an under-performer in light of a Bloomberg piece on ECB YCC (see bullets above).

AUD/USD tracked higher to circa 0.7725 (GVP, NZD, CAD all higher also) but has dipped a few points from there coinciding with comments out of China opposing US statements on Xinjian (see bullets above) and previous highs for the pair in the region of 0.7720/25 (short-term highs).

The PBOC added the most cash to the country's financial system today in 4 months to help assuage any liquidity constraints with tax payments due (19 to 22 January). The 7 day repo rate climbed for a 6th day to 2.5% and its highest since mid-November last year.

And, a heads up - US President Biden will be issuing executive orders from 5.15pm local time (2215 GMT). Indications have already been given he will be cancelling Keystone but there could be other day-one moves pending also.