Forex news for Asia trading Thursday 21 March 2019

- Here is how FX hedge funds are trying to make a buck in this low volatility time (gold!)

- Response to AUD jobs data: caution on January/February seasonality

- Asia FX intervention - here is when to expect it

- New Zealand credit card spending for February +0.2% m/m (prior +1.4%)

- Responses to AUD jobs data coming in: AUD finding some love

- Responses to AUD jobs data coming in: RBA will breath a little easier

- US press: President Trump just sidelined his own top negotiator on North Korea

- PBOC sets USD/ CNY reference rate for today at 6.6850

- Australian police raid forex broker

- First Australian press headline I've seen: unemployment rate lowest in eight years

- Australia jobs report (February): Employment Change +4.6K (vs. expected +15K)

- German Foreign Minister says delay to Brexit is good if leads to orderly result

- UK private-sector employers expect to give base annual pay rise of 2.5% this year

- South Korean exports in March (so far) down 4.9% y/y

- White House economic adviser Hassett says 'trade deals are 'moving forward'

- NZ GDP responses coming in

- Japanese press report PM Abe to visit the US in April, meet with Trump

- German finance ministry - growth likely to remain subdued for first half of 2019

- New Zealand GDP q/q came in bang on line - RBNZ implications

- NZD approaching its FOMC high after GDP data

- New Zealand Q4 2018 GDP: 0.6% q/q (expected 0.6%)

- Brexit - Here's what was new in UK PM May's speech moments ago (spoiler, nothing)

- Trade ideas thread - Thursday 21 March 2019

- Brexit - UK PM May says will not leave the EU on March 29

- Fitch Ratings on Canada - deficits still in line with a falling debt ratio

- Brexit - UK MP says PM May ruled out calling a general election

The session got off to a start with UK PM May speaking, very briefly, and adding nothing we didn't already know. Since her speech cable ticked steadily higher to above 1.3220 and is just under there as I post as we await the next round of Brexit headlines.

Data from NZ was soon up, fourth quarter 2018 GDP which came in:

- In line for the q/q, but well ahead of Q3

- A miss for the y/y

- And under the RBNZ projections

NZD had jumped on the FOMC announcement earlier and retraced circa 50%, and on the GDP data release it jumped again, testing its post-FOMC and high, tracking sideways for a couple of hours and then surpassing it. As I post NZD/USD is off its day's high.

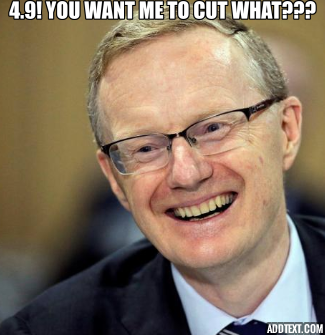

The second pop higher for NZD came about the same time as the Australian dollar moved higher upon release of the February employment report. The report was not bad, but it was not great either, with both positives and negatives (see bullets above). On balance I reckon it was a bit soft, but there is a big BUT ... the unemployment rate cracked under 5.0%, to 4.9% (if you care to there are plenty of 'rounding' discussions to track down, but the headline is 4.9%). That "4.9%" rate hit the headlines, its the lowest in 8 years. It removes, for now, the possibility of a near term RBA rate cut.

Dunno how RBA Gov. Lowe responded, but something like this is likely.

The details of the report do indicate some momentum coming out of the labour market, and that may well show up in the months ahead. But for the session the AUD made hay, moving above 0.7160. Its dipped towards 0.7150 as I update.

USD/JPY had dripped a little lower on the session, in a very small range only. A small range too for EUR/USD, sitting above 1.1420 for most of the day. USD/CAD is little net changed for the session, as is USD/CHF.

Gold has had a good day, adding a few dollars. Thanks Jerome.

Still to come: