Forex news for Asia trading Thursday 25 June 2020

- US firm GNC paid nearly $4 million in executive bonuses 5 days before filing bankruptcy

- 2 firms to build Singapore's 5G network - Huawei is not one of them

- BofA see gold to record highs - here are the levels they are watching

- Australian job vacancies for the 3 months to May have their largest drop on record

- Economists expect the worst is over for the UK economy

- FX option expiries for Thursday June 25 at the 10am NY cut

- Australian state of Victoria racking up more coronavirus cases

- Goldman Sachs CEO Solomon still sees a V-shaped recovery for the US economy

- US Coronavirus - Nevada governor signs order to require face masks to be worn in public

- Australia - CBA update their GDP forecasts to not as deep a contraction as previously

- More from Qantas - domestic flight schedule to return to 70% this year

- Citi sees oil prices continuing to rebound over the next 18 months - forecasts

- New Zealand trade balance for May: NZD 1253m (expected NZD 1290m surplus)

- Australia - Up to 1000 military to be stationed to support COVID-19 efforts

- Australian air carrier QANTAS to cut 6000 jobs

- More info on the Pentagon listing 20 companies aiding Chinese military

- M5.9 earthquake south island of New Zealand

- FBI Director says China is the most comprehensive threat to the USA

- EU says US threats of further tariffs on $3.1bn of European products “very damaging”

- Navarro says Trump may impose retaliatory tariffs if China is not buying enough US lobsters

- Brexit - EU signals compromise possible in trade talks with the UK

- US coronavirus - California is unlikely to recover its pre-coronavirus prosperity over the next three years

- Texas coronavirus cases up 5551 vs 5489 yesterday

- Trade ideas thread - Thursday 25 June 2020

- Texas Governor says there is a massive virus outbreak sweeping the state.

- Citi sees slow consumer spending in Asia - impact on US economic recovery

- US coronavirus - Houston is on track to exceed its ICU capacity by Thursday

- Trump’s national security adviser speech today, equated China's Xi to Josef Stalin

Markets in China were closed for a holiday today, they'll be closed again on Friday and back on Monday.

Its often the case that FX trades in subdued ranges on Chinese holidays and today was no exception. We followed on from drops in US markets on Wednesday with weaker equity markets here in Asia, of course.

EUR and JPY have both continued their losses against the USD during the session, albeit like I said in small ranges. AUD and NZD showed a little higher but have since come back to be little net changed as I post. CAD falls into the little net changed basket also, while GBP is just a touch weaker.

News flow was light, we saw reports from the US afternoon of continued steep rises in US coronavirus cases and hospitalisations, and as the morning progressed in Australia we got the number from outbreak hotspot Melbourne in Australia reporting its highest new case number in 2 months.

Data flow, too, light. NZ trade data showed the impact of weaker coronavirus-impacted domestic demand on imports, slowing noticeably.

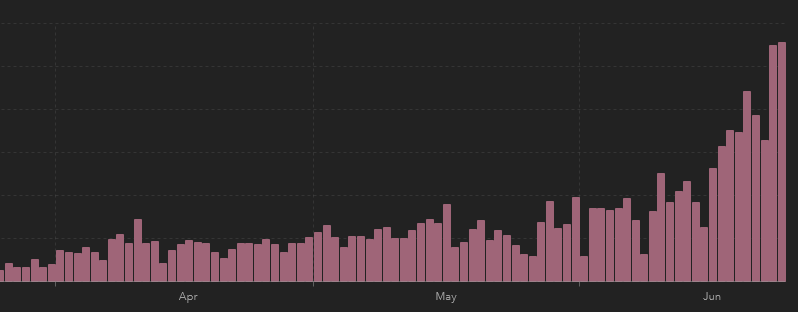

Texas coronavirus curve, the opposite of flattening: