Forex news for Asia trading Friday 30 September 2016

- Please be careful gentlemen: Man bitten by spider twice (guess where ...)

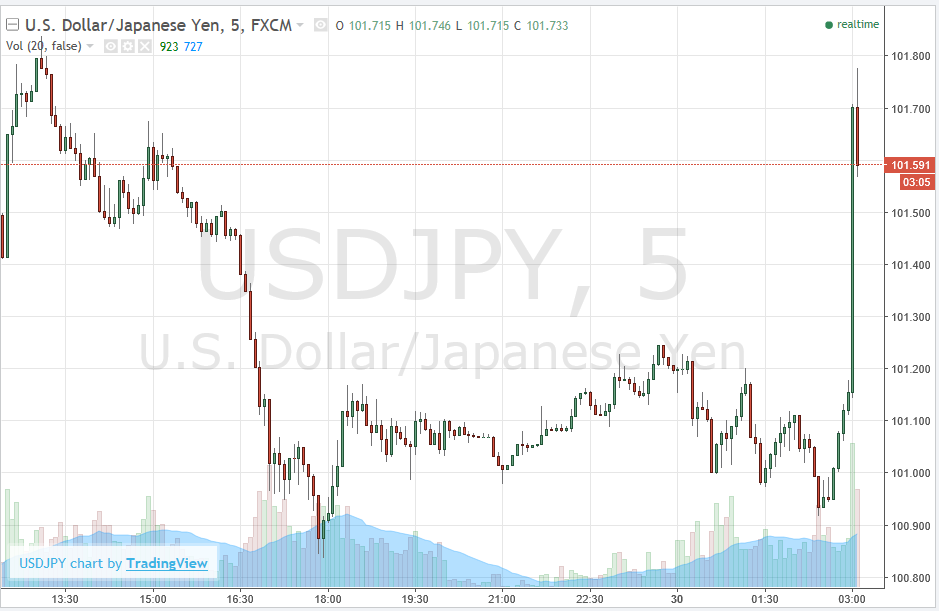

- Yen hit ... USD/JPY surge

- Does satellite imaging show China has stockpiled 600 million barrels of oil?

- The UK economy is flying blind 100 days after the Brexit vote

- WSJ reports: BOJ Kuroda seeks inspiration from 'Anne of Green Gables'

- Caixin China Manufacturing PMI for September: 50.1(expected 50.1, prior 50.0)

- Former US Treas. Sec Summers: BOJ commitment to inflation overshoot right

- Australia - Private Sector Credit (August): 0.4% m/m (expected +0.5%)

- While we're on the yuan - it joins the IMF's SDR tomorrow!

- PBOC sets USD/CNY central rate at 6.6778 (vs. yesterday at 6.6700)

- Australia - HIA New Home Sales for August: +6.1% m/m (prior -9.7%)

- Japan - bond buyers already testing credibility of BOJ's new monetary policy framework

- NZ - ANZ Business Confidence 27.9 and Activity Outlook 42.4

- Bank of Japan 'Summary of Opinions' from the September policy meeting

- Japan Industrial Production (August preliminary): +1.5% m/m (expected +0.5%)

- Japan CPI, headline in at -0.5% y/y (vs. expected at -0.5%)

- Japan - Overall household Spending: -4.6% y/y (expected -2.1%, prior -0.5%)

- BOJ governor Kuroda to appear before Japanese parliament from 0430GMT

- NFP preview! (What? Too early? OK then, file away until next week)

- Australia, NZ & Canada - 3 scenarios for how the housing boom will play out

- UK (Sept.) data: GfK consumer sentiment -1 (expected -5) + more

- More on Yellen saying Fed able to buy equities, corporate bonds could be helpful

- HSBC says the RBA is done cutting rates ... but AUD a key challenge to their view

- New Zealand - Building permits (August): -1% m/m (prior -10.5%)

- Banks tightening SWIFT security after hackers steal money

- Nissan wants Brexit compensation as a condition for new UK investment

- Trade ideas thread (TGIF edition) - Friday 30 September 2016

- ECB's Lautenschläger: No need for further stimulus

- Fed's Yellen Q&A now: New tools for the Fed not a pressing issue right now

- Fed's Yellen speaking - no comments on monetary policy nor eco outlook

The Japan CPI was today's main Asia focus. Earlier on we got a few comments from Federal Reserve Chair Yellen, nothing much of note for the markets (see bullets above for the remarks, but really, don't bother).

Japanese CPI data showed another disappointing set of numbers. At least Japanese core-core inflation (excluding food and energy) was positive, not in deflation like the rest of the measures, but at +0.2% (national, y/y) its an order of magnitude away from the Bank of Japan target. Still.

The 'overall household spending' data for August came in at another big miss. Down 4.6% y/y against a down 2.1% median expected. On the bright side, industrial production (the preliminary for August) showed improvement.

We got other data from around the place today, NZ buildng approvals little changed on the month, but business activity outlook and confidence (ANZ survey) surging and setting up potential 4% GDP growth said ANZ. Australian new home sales bounced from a big drop the previous month, not as a big a bounce as the prior drop though.

The China private manufacturing PMI (Caixin) edged a little higher on the month, from 50 to 50.1. Note that it's the Golden Week holiday in China next week, so data flow from there will dry up somewhat. But we will be getting the official manufacturing and non-manufacturing PMIs for September on the weekend (Saturday 1 October due at 0100GMT).

And so to currency movements. If I had have written this an hour ago I would've said it wasn't much of a day. Narrow ranges prevailed nearly across the board, with most little changed on the session.

And then, this ...

Yep, a huge jump in yen crosses. Unconfirmed reports of a BOJ ring-around (note again, unconfirmed). But, it may be only due to Bank of Japan Kuroda apparently going a little bit nutty ;-). Maybe that's his cunning plan! (Added - maybe a Larry Summers comment)

Regional equities:

- Nikkei -1.30%

- Shanghai +0.14%

- HK -1.27%

- ASX -0.58%

Still to come:

- BOJ governor Kuroda to appear before Japanese parliament from 0430GMT

- Bank of Japan's measure of inflation will be released at 0500GMT: expected 0.4%, prior 0.5%

- Economic data due from China over the weekend - official PMIs for September.

More:

- South Korea's September Manufacturing PMI came in at 47.6, the lowest in 14 months

- NZ M3 Money Supply for August +5.3% y/y (prior +6.30%)