Forex news for Asia trading Monday 7 October 2019

- ECB and FOMC meeting minutes are due this week

- China riskiest debt being sought after at a record pace

- FX option expiries for Monday October 07 at the 10am NY cut

- Its time for the daily reminder - China on holidays, no CNY mid rate setting today

- Business confidence data due from Australia on Tuesday - preview

- ANZ forecast NZD to 0.59 by end of Q1 2020

- China's gold reserves data shows the country bought more again in September - up for the 10th month in a row

- NZD traders - a little-watched survey shows business confidence is falling further

- Fed's George (Q&A): Consumers have been confident, if this diminishes might rethink on rates

- EUR/USD trade - target and stop loss

- Fed's George says if data points weaker easier policy may be appropriate

- Weekend data from China - foreign exchange reserves fell more than expected in September

- Australia construction PMI for September: 42.6 (prior 44.6)

- Brexit - UK PM Johnson to ask Supreme Court if he must seek an extension

- More on China said to be offering less to US in this week's forthcoming trade talks

- HKMA on that cash withdrawal limit at ATMs - "totally fake and unfounded"

- FT reports that HSBC is to axe up to 10,000 jobs

- Trade talks - reports China will not consider negotiating some key US complaints

- Brexit - UK PM Johnson says again UK is leaving EU on October 31 deal or no deal

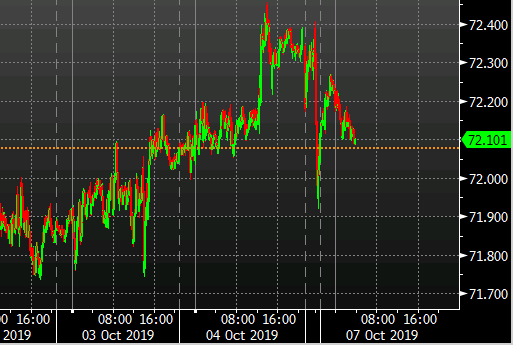

- Monday morning forex opening price indications - 7 October 2019

- The ultimate week ahead playbook

- Former top ECB officials sign joint letter criticizing Draghi's policies

- China pulls out of $5 billion deal to develop Iranian natural gas

- Second Trump whistleblower weighing whether to step forward

Early Monday news pre-Tokyo trade was that China wants to place certain US demands off-limits in the trade talks recommencing this week. Such as industrial policy reform and government subsidies. These are two key US complaints. It remains to be seen how the US will respond.

The forex move was as expected, with a sell-off for the key AUD/JPY 'risk barometer'. The move lower was fairly small though, perhaps indicative of the already existing lack of market conviction on anything meaningful coming out of these talks.

US equity index futures opened lower a little while later (on the Globex reopen) reflecting the news.

As usual, there was a barrage of Brexit-related news over the weekend. The PM insisting October 31 is the exit date deal or no deal and seeking ways to subvert parliament's requirement he requests an extension.

Further on the political front, check these out:

- US announces it will no longer be present in Northern Syria area

- Japan press says a North Korean fishing vessel has collided with a Japanese Fisheries Agency patrol boat

- NBA / China / Hong Kong .... in the context of trade talks will this escalate?

Currency movement was not large. A minor wiggle for EUR/USD but its not a lot net changed from late Friday. Cable is down just a few tics. USD/JPY ditto.

AUD/USD is net down 10+ points on the session while USD/CHF is up a similar amount, USD/CAD also.

Oil is opening the weak a touch softer in price while gold is little changed. Over the weekend BTC lost a few hundred USD and continued that today here.