Forex news for Asia trading Tuesday 9 July 2019

- Mexico's dep foreign minister says ratification of new NAFTA is not in danger

- Gold bought by central banks in 2019 on track for 700 tons (651.5 t in 2018)

- One for the crypto folks - PBOC wants Facebook’s Libra under central bank oversight

- Hong Kong leader Carrie Lam says the extradition bill is 'dead'

- Australia June Business Confidence 2 (prior 7) & Conditions 3 (prior 1)

- US approves major arms sale to Taiwan

- People’s Bank of China sets yuan reference rate at 6.8853 (vs. yesterday at 6.8881)

- Japan's industry minister says export restrictions could be eased, or strengthened

- NZD traders - here's an analyst looking for more RBNZ rate cuts ahead

- "What to expect from China’s economy" - dual-mainline of “big consumption & new economy”

- Japan, South Korea officials to hold bilateral trade talks this week

- Australia - ANZ Roy Morgan Weekly Consumer Confidence: 117.6 (prior 118.9)

- Japan wages data for May - cash earnings and real cash earnings both fall

- UK's Hammond told PM May he will fund her plans as a trade-off for her free vote to stop a no-deal Brexit

- Ex-PBOC official says the yuan to rise over the long term

- UK data - BRC sales like-for-like -1.6% y/y (vs. expected -1.1%)

- Australian prudential regulator winds back capital requirements call on banks

- Australia - AFR says RBA rate cuts, government tax cuts are 'more than enough' stimulus

- NZ Deputy PM Peters is taking credit for the falling NZD, but not for falling business confidence

- New Zealand - ANZ Truckometer for June: -4.5% m/m (prior +0.8%)

- UK PM May says UK's ambassador to the US has her full support

- Senior Chinese diplomat warns of ‘disastrous consequences’ if US treats China as ‘enemy’

- US tariffs news - to impose levies on structural steel from China and Mexico, but not from Canada

- Trade ideas thread - Tuesday 9 July 2019

USD/JPY initially traded higher in the Asia morning, moving towards 108.90 but failing to carry on higher from there. Its subsequently come back under 108.80. There was little news nor data to account for the move (we did get Japanese wage figures for May, showing the fifth consecutive year-on-year decline).

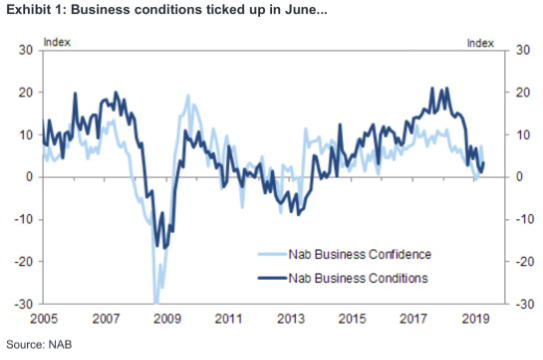

Moves elsewhere were limited also, and also with little news nor data impact. Australia was a bit of an exception. We had the June iteration of the National Australia Bank Business Survey which showed a drop from business confidence (to 2 from a prior 7) and a rise for business conditions (to 3 from the previous 1). Both well, well down from highs and barely holding long-run averages. The employment sub-index was of particular interest, given the RBA focus on labour market developments. It rose to 5 (from May's 2, and April's -2), an encouraging sign.

Chart via Goldman Sachs' response piece to the data, illustrating the fall for the measures in past months:

AUD/USD slid from highs circa 0.6975 on the session to lows around 0.6955.

NZD/USD had a small range and is net little changed for the day. Something to note is the NZ Deputy PM giving the government credit for the lower NZD (see bullets above). This should create an interesting response if it comes to the attention of the Tweeter in Chief in the US - Trump will not be impressed by a foreign government achievements lowering a currency against the USD.

EUR, GBP, CHF, CAD are all not a lot changed against the USD on the session. Gold also. BTC/USD gained.

Still to come: