Forex news from the European trading session - 10 August 2018

Headlines:

- Russia's Medvedev says Moscow is to treat US sanctions as act of economic war

- UK June visible trade balance -£11.38 bn vs -£12.36 bn prior

- UK June manufacturing production +0.4% vs +0.3% m/m expected

- UK Q2 preliminary GDP +0.4% vs +0.4% q/q expected

- Italy June trade balance €5.07 billion vs €3.38 billion prior

- IEA says oil supply fears have abated after production boost

- France Q2 preliminary private sector payrolls +0.2% vs +0.3% q/q expected

- France June industrial production +0.6% vs +0.5% m/m expected

- Italy government plans 2019 public deficit at 1.7% of GDP - report

- German 10-year bond yields touch lowest level in 3 weeks

- Turkish lira slide continues, now more than 7% lower against the dollar

- Turkey's Erdogan: Even if they got dollars, we got 'our people, our God'

- Japan June tertiary industry index -0.5% vs -0.3% m/m expected

Markets:

- JPY leads, AUD lags on the day

- European equities all lower

- Gold down 0.10% to $1,211.19

- WTI flat at $66.81

- US 10-year yields down 3 bps to 2.895%

- Bitcoin down 2.12% to $6,370

A fitting one-liner for the session would be 'All roads lead to Turkey'. The lira was one of the main stories of the day as it stumbled before the start of European trading. At the time, word on the street was stops being triggered in TRY/JPY which prompted the fall but the declines were just beginning as the lira fell by 13.5% at the peak of the rout to 6.30 (from Bloomberg's composite) against the dollar.

The lira did pare some losses thereafter as all eyes now turn to Erdogan's address at the top of the hour.

During the twilight period between Asian and European trading, the ECB was reported to have expressed concerns about regional banks' and their exposure towards Turkish credit. That prompted further worries in equities and banking stocks on the day and contributed to further gains in the yen.

And right before European trading began, the dollar made a break to the upside with the dollar index touching its highest levels since July 2017. That took EUR/USD down below 1.1500 past barrier options and bids in a swift move lower.

The greenback was bid across the board and remains that way throughout, although it has retraced some of its earlier gains currently. The only other currency to have held rather steady against the dollar is the yen as it continues to outperform the rest of the major bloc after the Q2 GDP beat in Asian trading and the risk-off mood we're seeing in markets today - as a result of contagion fear from Turkey, EM markets being roiled, and lower equities.

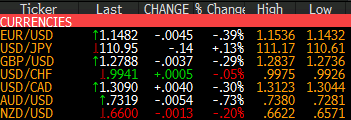

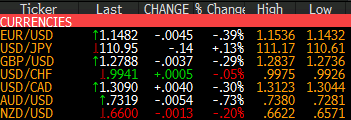

Looking at individual currencies, EUR/USD traded around 1.1510-20 at the end of Asian trading before taking a swift dive lower to 1.1480 levels before European trading began. The pair then tested the 1.1450 level before moving lower to lows of 1.1432 on the day and retracing thereafter. The daily support at 1.1448 remains a key level to watch out for in trading today.

USD/JPY started the session near the lows as the yen was buoyed by better economic data before moving higher as the dollar caught a bid across the board to 110.90 levels. The pair retraced some of those gains towards 110.70 as the yen benefited from the risk-off mood but is now moving higher again towards the 111.00 level ahead of US trading.

GBP/USD surprisingly did not suffer much when the dollar jumped before the start of European trading. The pair fell to lows of around 1.2790-00 levels and held around there before moving lower once traders in Europe joined the fray. The low tested 1.2736 before bouncing back as towards current levels as the dollar retraced some of its earlier gains.

AUD/USD is one of the bigger movers on the day as the aussie is the weakest major currency so far. The risk-off mood in the market is among the contributing factors to the weak aussie seen today. AUD/USD continues to test the daily support at 0.7329 and the lows today touched 0.7281, also more than one-year lows before recovering a little now.

Moving ahead to US trading, all eyes will be on the CPI report and whether or not there will be a continuation of the risk-off theme seen in European trading so far.