Forex news from the European trading session - 16 August 2018

Headlines:

- Italy's MIB remains the red spot among European equities

- Eurozone June trade balance €16.7 billion vs €16.9 billion expected

- UK July retail sales +0.7% vs +0.2% m/m expected

- It just got a lot more painful to short the yuan

- China July FDI data adds to positive tones in the market

- Germany July wholesale price index 0.0% vs +0.5% m/m prior

- Former BOJ economist says Japan may slip into recession either in 2019 or 2020

Markets:

- AUD leads, JPY lags on the day

- European equities higher, only Italy's MIB is lower

- Gold up 0.32% to $1,178.60

- WTI up 0.06% to $65.05

- US 10-year yields up 1.5 bps to 2.877%

- Bitcoin up 0.20% to $6,388

The trading ranges for the day are pretty decent as we head into US trading but a lot of the move came from an earlier spike in Asian trading here. European trading went by a little quieter with risk sentiment improving a little helping to support the mood seen from Asia but doing little to see any notable extensions.

Perhaps, the notable thing so far today is that there is a bit of a market anomaly occurring in the Chinese offshore yuan forwards market where we're seeing a squeeze in USD/CNH as forward points jump up by the most in almost seven years.

And that is contributing to part of the dollar's weakness so far today. That aside, we're seeing a rebound in risk sentiment as European equities and US equity futures are trading higher. Metals are also showing a minor rebound on the day and that is helping to lift commodity currencies so far.

But despite all of that, the bounces are rather minimal and investors are not getting swept up by the optimism so far. And that goes to show the cautious and fragile tone that is still in place right now. All it takes is one negative headline or one bad tweet and all of this will start to turn around once again.

The yen is the weakest performing major currency on the day as a result of the improved risk sentiment while the dollar is also among the laggards. Meanwhile, the pound is feeling heavy and looks poised for further declines as even a more upbeat retail sales report is not helping to lift the mood.

And sitting firmly at the front is the aussie and kiwi as they benefit from better Chinese data and a more positive tone in the market.

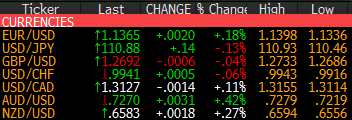

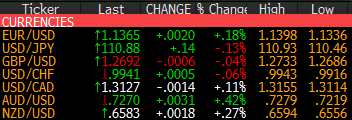

Looking at individual currencies, EUR/USD started the session around 1.1370 levels before climbing to a high of 1.1398 but offers near the 1.1400 level kept price in check and the pair has now fallen back below the 100-hour MA to trade around 1.1360-70.

USD/JPY has had a more subdued session as the pair range-traded between 110.60-90 for the most part. Meanwhile, GBP/USD saw a move towards the week's high and traded to 1.2733 before falling to 1.2700 levels ahead of the retail sales report. The pair spiked to 1.2730 after but subsequently fell back to trade at the figure level as longer-term worries are still at play for the pound.

USD/CAD had a more subdued session after trading to session lows early on. The positive mood in markets is helping the loonie but the lack of any notable rebound in oil prices is making it difficult for the currency to see a major bounce of any sorts. The pair traded around 1.3120-35 for the majority of the session.

AUD/USD looks to be a lively pair on paper but ended up trading around 0.7250 to 0.7270 for the most part in European trading. The aussie continues to be supported by better risk sentiment and buyers appear to be forming a near-term base in the pair despite the fact that domestic bond yields are falling.