Forex news from the European morning session - 18 June 2019

Headlines:

- ECB officials reportedly see rate cut as primary tool for any new stimulus

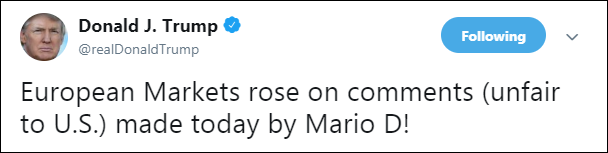

- Trump takes a dig at Draghi, says remarks make it 'unfairly easier for them to compete against the US'

- OPEC said to propose meeting on 8-12 July, await responses

- Germany June ZEW survey current situation 7.8 vs 6.1 expected

- Eurozone April trade balance €15.3 billion vs €17.0 billion expected

- ECB's Draghi: More rate cuts are part of the central bank's toolkit

- Andrea Leadsom pledges support for Boris Johnson in Tory leadership race

- Microsoft quietly resumes sales of Huawei laptops online

Markets:

- JPY leads, EUR lags on the day

- European equities higher; E-minis up 0.6%

- US 10-year yields down 7.4 bps to 2.02%

- Gold up 0.8% to $1,349.92

- WTI flat at $51.91

- Bitcoin down 1.3% to $9,156

It was all about Draghi in the European morning today as he gave markets more food for thought about further ECB stimulus over the next few months with dovish remarks in Portugal. He touted the idea of rate cuts, which was then supported by a Bloomberg report, and that was enough to send the euro lower.

EUR/USD dropped by ~60 pips from 1.1240 to 1.1181 during the session as markets accelerated a 10 bps rate cut by the ECB from March 2020 to September 2019 currently. The pair holds just under the 1.1200 handle ahead of North American trading.

Draghi's remarks helped to send equities higher amid of increasing dovishness among global central banks with US equity futures running higher to post gains of 0.6% after having been down by 0.2% beforehand.

European equities also rose sharply but bond yields in the region suffered and that added to a further drag in Treasury yields, which are down heavily across the curve. That in turn is putting pressure on yen pairs with USD/JPY trading near session lows at 108.20 levels.

Other than that, the pound is failing to gather any reprieve amid political and Brexit uncertainty as we await the second round of voting for the Tory leadership race. Cable fell to five-month lows overnight and is tracking lower again now falling to 1.2510 levels from 1.2530 at the start of the session.

Gold remains a standout performer as price starts to chip at the $1,350 handle again and is making new highs on the session as I type this out. Looking ahead, it's all about how market participants view the Fed tomorrow now so expect that to continue to dictate trading sentiment over the next few sessions.