Forex and cryptocurrency news from the European trading session - 4 April 2018

News:

- China says it has today initiated WTO dispute settlement procedure against US

- China says that US investigation has no factual basis

- China's WTO envoy pledges retaliation over US trade tariffs

- Latest US tariff measures on China products a further step in the wrong direction - report

- China is able to deal with any trade protectionism - Xinhua

- China vice finance minister says that China doesn't want a trade war

- China says that tariffs implementation date depends on talks with US

- China's vice finance minister hopes all problems can be solved via WTO

- Yen demand returns to send core pairs lower but dip buyers poised still

- China's aggressive stance shows that trade tensions are getting serious

- More from China's trade briefing: Cannot accept Trump's $100 bn deficit cut requirement

- Germany says it's important to talk with China as well as US on trade

- China's finance ministry confirms additional tariffs on US goods

- China to levy reciprocal tariffs on 106 US products - state media

- US equity futures not liking China's response on trade so far

- More from China: Countermeasures on US tariffs to come "very soon"

- China says that planned tariffs are to defend its legitimate interest

- Currency traders are starting to get the hint

- China says that US has repeatedly missed best opportunities for resolution on trade

- Chinese government is to hold a briefing later today on China-US trade

- Bitcoin in retreat again after rally sellers prevail

- A little taste of what cryptocurrency association can do for your stock

- Don't expect the Eurozone inflation report later to sway the ECB's stance

- Trading ideas for the European session 4 April

- Nikkei 225 closes higher by 0.13% at 21,319.55

- The aussie has that familiar feeling again

- JP Morgan says that tariffs are not the solution to US' trade deficit with China

- New Zealand Treasury says that consumption should continue to support growth

- ForexLive Asia FX news: AUD higher after data beat (retail sales)

Data:

- Eurozone March flash CPI y/y +1.4% vs +1.4% expected

- Eurozone Feb unemployment rate 8.5% as exp

- UK Markit/CIPS March construction PMI 47.0 vs 51.0 exp

- Italy February unemployment rate 10.9% vs 11.0% expected

Phew! Got enough China trade war headlines there? lol. It's been all about US-China trade spats today and that has seen some risk-off sentiment, with falling equities adding to the fragility.

USDJPY opened up looking solid above 106.50 but from 106.65 came the steady retreat as the Chinese rhetoric saw yen demand return and we've been down to test 106.00 with yen pairs falling and driving core pairs lower too.

GBPJPY has been down to 148.82 from 150.00 and that's pushed GBPUSD down to 1.4028 after once again failing at 1.4100. EURUSD rallied to 1.2315 from 1.2280 as EURGBP spiked to test 0.8750 from 0.8725 on the GBP supply. EURJPY sellers though helped cap the rally and we've been back down to 1.2280

Similar story across the board with AUDUSD falling back to 0.7665 from 0.7700 pushed lower by AUDJPY supply. NZDUSD posting lows of 0.7265 no NZDJPY selling but both finding dip demand.

CHF demand has been less noticeable, probably on fears that SNB will be there to prop up any heavy falls, but has capped at 0.9600 with EURCHF posting 1.1779 on general EUR demand.

USDCAD has seen some money come off the table after yesterday's NAFTA-led falls and with CADJPY sellers in play we've been up to 1.2844

Bitcoin has had a soggy day after yesterday's strong rally and after failing to breach $7500 we've been down in solid retreat to $7057.

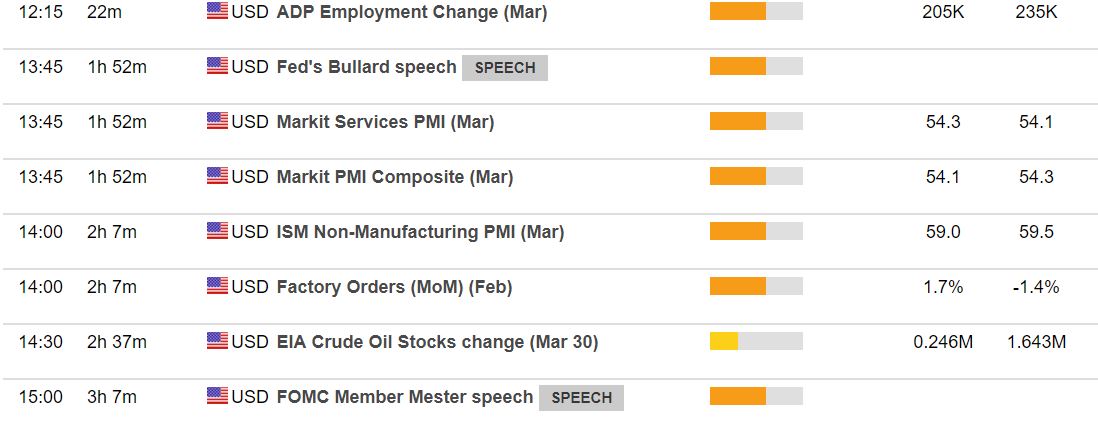

US data and Fed heads to come: