Forex and cryptocurrency news from the European trading session - 9 April 2018

News:

- China premier Li says unilateral trade war will hurt common interests globally

- China said to study CNY devaluation as a tool in trade spat - report

- China says that no negotiations have been conducted with the US

- China's vice commerce minister calls for nations to defend WTO

- PBOC adviser says that US seeks to contain China's rise via trade war

- Former US commerce secretary says US-China trade deal unlikely to happen in next 2 months

- More from Kuroda: Setting BOJ inflation target at 2% was not a mistake

- BOJ's Kuroda: Inflation still distant from central bank's target

- BOJ's Kuroda says will continue with powerful easing to achieve price target

- Nordea says that Trump has the upper hand against China

- ING says China is showing the extent of tools it may deploy in a trade war

- Not your average trading day as the AUD and JPY sit at the bottom of the pile

- FCA's Bailey says EU and UK regulators should not delay working together to ensure smooth Brexit

- China premier Li says China will further deepen reforms and opening up its economy

- SNB total sight deposits w.e. 6 April CHF 574.9 bn vs CHF 575.4 bn

- AUD/NZD slips to year's low, eyes key long-term support level

- AUD slips after news of China potentially devaluing the CNY

- European equity markets open firmer 9 April

- Trading ideas for the European session 9 April

- ING says Germany could be first prominent victim of US-China trade war

- Australia March foreign reserves AUD 76.6 bn vs AUD 70.8 bn prior

- Nikkei 225 closes higher by 0.51% at 21,678.26

- South Korea warns that "stern" measures may be taken in the FX market

- Performance in Asian equities today highlight confidence in Xi Jinping

- MOF official says Moritomo lawyer was asked to lie

- Former PBOC adviser says that a US-China currency war is unlikely

- China-US trade friction to have limited economic impact - report

- Japanese investors dump record amount of US bonds in February

- BofAML says China may target services from US as retaliation

- Leveraged funds were net buyers of USD for the second consecutive week

- Are US soybeans on sale? European buyers seem to think so

- EUR/USD continues to hang on to key support levels

- ForexLive Asia FX news: Plenty of geopol to drive FX ... but doesn’t

Data:

- UK Halifax March HPI mm 1.5% vs 0.1% exp

- Germany February trade balance +€18.4 bn vs +€20.1 bn expected

- Eurozone April Sentix investor confidence 19.6 vs 20.8 expected

- Switzerland March unemployment rate 2.9% vs 3.0% expected

- Japan March consumer confidence index 44.3 vs 44.5 expected

Trade war rhetoric continues to dominate the headlines and with market still guessing as to which way the cards will fall, FX prices have seen limited range so far today.

Yen and swiss franc supply and demand on risk sentiment remain prime drivers and we've seen both sides this morning resulting in a stalemate for the morning. USDJPY had an early wobble below 107.00 on news China is considering yuan devaluation as a retaliatory trade measure

but we've mostly been pinned around 107.10.

GBPUSD similarly has mostly been 1.4100-10 contained in a 1.4080-1.4120 range but with attempts as both ends. EURGBP has been trawling around 0.8700 and EURUSD 1.2270

USDCAD picked up a bid from 1.2780 to post 1.2820 before setting back on a round trip while USDCHF has found support at 0.9590 and resistance 0.9610.

AUDUSD has mostly been on the back foot on China concerns and failure into 0.7700 has seen retreat to test the other end of the range at 0.7650. NZDUSD too has failed above 0.7300 to post 0.7285 in what has generally been a soggy session for commodity currencies.

Bitcoin has had a poor start to the week with the mined one's latest rally capped at $7150 and falling in a straight line to $6700.

Equities opened a little firmer and have held early gains, while oil has also held steady and nudged higher . Gold drifted lower from $1334 to $1326 adding to AUD weakness.

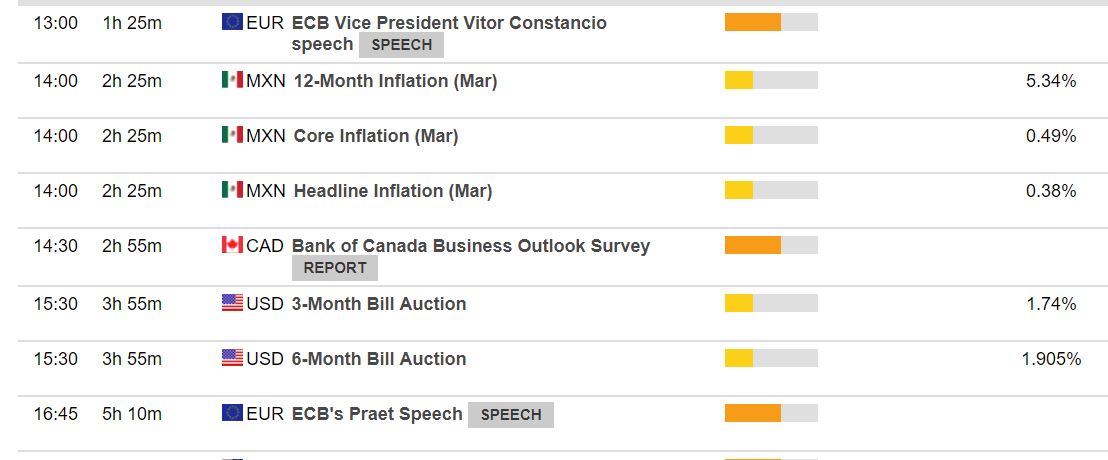

Data and ECB talking heads coming up: