Forex news for North American trading on November 11, 2020

- NASDAQ index rebounds 2% and closes near the highs

- WTI crude oil futures for December settled $0.09 higher at $41.45

- New Zealand October home sales rise 25% year on year

- US Covid deaths spike up to 1,859 vs. 694 yesterday

- European major indices close higher for the 3rd consecutive day

- UK Covid cases rise by 22,950 vs. 7 day average of 22,842

- Italy reports 32,961 new coronavirus cases on Wednesday

- Georgia Secretary of State to announce a hand recount of votes

- The NZD is the strongest and the EUR is the weakest as NA session begins

In other markets:

- Spot gold fell $11 and the sensor -0.63% to $1865.52.

- Spot silver rose $0.04 or 0.19% to $24.28

- WTI crude oil futures rose $0.27 or 0.65% to $41.63

The US debt market was closed in observance of Veterans Day.

In the US stock market, the flow funds returned back into the technology heavy NASDAQ index and out of the Dow 30.

- The NASDAQ index rose by 2.01% or 232.57 points to 11,786.43.

- Meanwhile the Dow industrial average fell 23.29 points or -0.08% to 29,397.63.

- The S&P was between those extremes. It rose by 27.13 points or 0.77% to 3572.66

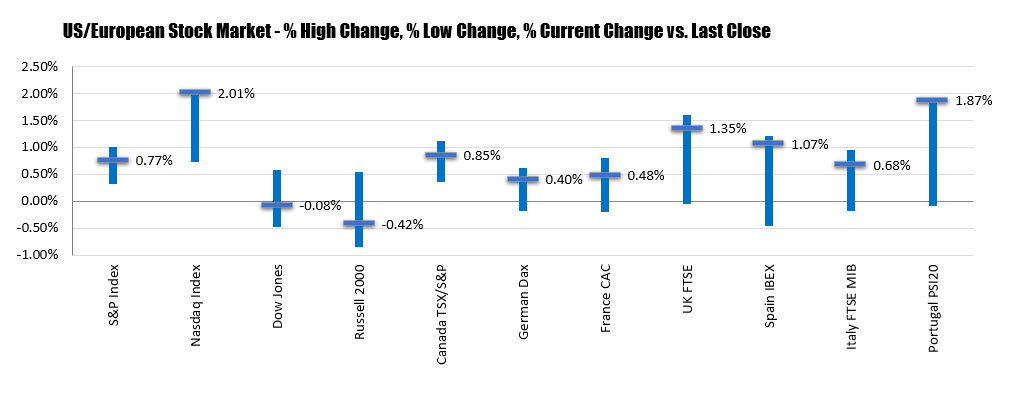

European shares closed higher for the 3rd consecutive day and 7 time in the last 8 trading days. Below is a summary of the changes in ranges for the major stock indices in North America and Europe

In the forex market today, the NZD was the runaway strongest of the majors. The gains were largely in the Asian session after the RBNZ said that the "unconstrained OCR track indicated the Bank now views that around 100bp less stimulus is necessary". The consensus expectations had been for the RBNZ to move to a negative cash rate from March 2021.

The NZDs gains were from 0.82% to 1.24% vs the major currencies.

The weakest currencies were the EUR and the GBP. Admittedly, each had most of their declines vs the NZD. However, fears of Covid and slowing growth, weighed on the currencies today.

The USD today saw a large -0.82% decline vs the NZD, but saw gains of 0.43% vs the GBP, 0.28% vs the EUR and 0.23% vs the CAD.

Technically speaking heading into the new day:

AUDUSD: The AUDUSD is closing right near its 100 hour moving average at 0.72787. The pair fell below the moving average at the start of the New York session and for the most part stayed below the level. However, in the NY afternoon, the price moved back higher to retest the MA level. That level will be the barometer for both buyers and sellers. Move above is more bullish. Stay below is more bearish

EURUSD. The EURUSD fell below its 200 hour moving average for the 1st time since November 5, but could not sustain selling pressure. The price moved back above in the late London morning session and stayed above the level. That 200 hour moving average is joined by the 50% retracement of the range since November 4 at the 1.17606 level. The current price is trading at 1.1778. In the new trading day stay above the 200 hour moving average of 50% retracement would be more bullish. On the topside the broken 38.2% retracement at 1.1798 and the Dow falling 100 hour moving average at 1.18309 would be targets. At the high of trading today, the price tested the 100 hour moving average but could not extend above.

GBPUSD: The GBPUSDs slide lower today came after trading to the highest level since September 4 at 1.33094 the low for the day extended to 1.31908. That was just above the rising 100 hour moving average. That level currently comes in at 1.31894. The current price is trading at 1.3216 into the close, and in doing so is above the swing hi from Mondays trade at 1.3208. Watch that level for intraday bias clues. Move below and run back down to test the 100 hour moving average is likely. Stay above and the buyers still remain in control in this pair