Forex news for NY trading on October 11, 2017.

- It's another record trifecta for the major US indices

- Forex technical analysis: EURUSD extends toward the next target

- Fed's Williams: Gradual rate hikes appropriate over next two years

- The euro has a two-week window to rally - ING

- Trump says if he can't make a NAFTA deal, it will be terminated

- FOMC meeting minutes: Many thought a fed rate hike was warranted this year

- Fed's Esther George: Fed should continue adjustment of rates

- US 10 year high yield 2.346%. Highest yield since May 2017

- Gold falls to session lows. Down on the day.

- European stock indices end the day with mixed results

- US sells $24bln 3 year notes at 1.657%. Highest yield since April 2010

- US EIA cuts forecast for 2018 world oil demand growth by 110,000 BPD

- Dr Copper back on the upswing ahead of National People's Congress

- Almost 20% of FX traders already invested in ICOs, half are open minded

- August US JOLTS job openings 6082K vs 6135K expected

- Feds Evans: Really nervous inflation expectations are really low

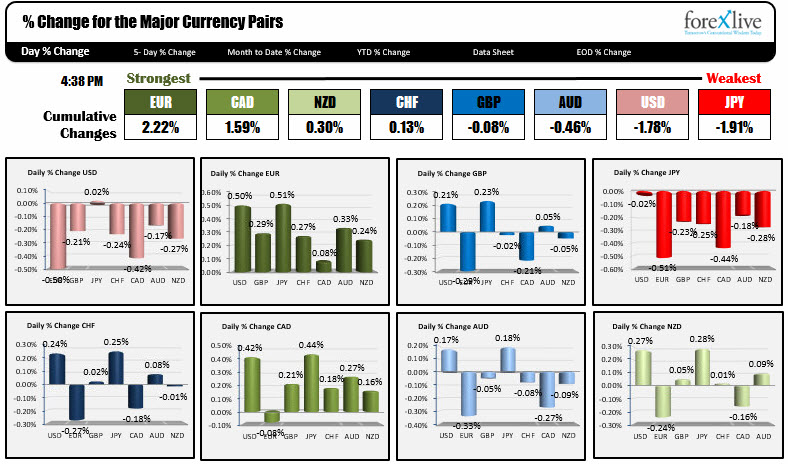

- Quiet day so far. JPY is the strongest. The GBP is the weakest

A snapshot of other markets near the day's close has:

- Spot gold is up $5.11 to 1293.13. The precious metal got a boost on a weaker dollar into the close. The $1296 area remains a key area to get to and through.

- WTI crude oil futures are ending the session up $0.40 or 0.79% to $51.32. The contract is closing near the high at $51.42. The low extended to $50.61 before the bounce higher into the close

- US stock indices closed at record levels. The S&P ended up 0.18%. The Nasdaq rose 0.25% and the Dow ended the session up 0.18%

- The US yields are mostly lower. 2 year yield is at 1.5165%, up 0.4 bp. 5 year is at 1.9512%, down -0.8 bp. 10 year is 2.3463%, down -1.4 bp and 30 year 2.8792%, down -1.6 bp

The JOLTs job report for August showed a total of 6082K job openings vs expectations of 6135K. Although lower than expectations, the total job openings remain near high levels. The other components were also a little softer than the prior month, but they too are coming off high levels. Employment is not a problem in the US.

The FOMC meeting minutes were a bit more dovish. Although many of the Fed officials saw another hike before year end, "many" also were concerned that low inflation was not only transitory (i.e.. low inflation was potentially more entrenched). That is what the market latched onto and the dollar moved lower into the NY, and day close. However, be aware that the markets are not exactly racing.

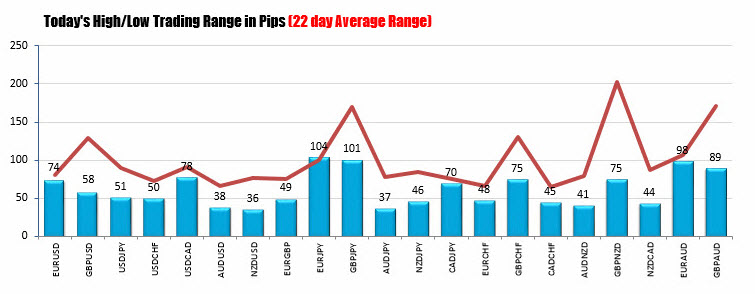

Looking at the low to high trading ranges for the day, the major pairs against the USD and the major cross currency pairs had trading ranges well below the 22 day averages (about a month of trading).

Taking a closer look at some of the major currency pairs, the EURUSD moved away (higher) from the 1.1822-32 area. That area defined a bullish above/bearish below divide. Moving above and away from the level was a more bullish play. Can it continue? The next key target comes in at the 1.1878-80 area where the 200 bar MA on the 4-hour is found AND the 50% of the move down from the September high. That level will test the buyers bullish desire. Look for sellers on the first test (at least).

The USDJPY is actually ending the day little changed. The pair fell below a key floor area at 112.208-112.316 for the 2nd consecutive day earlier in the NY session, but recovered in the NY afternoon session. The pair's rise higher stalled ahead of the 100 hour MA at 112.58 (the 200 hour MA is a bit higher at 112.664) just before the FOMC minutes (the high reached 112.56). When the minutes came out more dovish, the price fall but found support buyers against the 112.316 level (high of the aforementioned floor area). Not being able to move back below the 112.208-316 area, shows the sellers are now hesitant after the two failed breaks. Can the buyers push higher in the new day? Requirement #1 is to stay above 112.208-31. Requirement #2 is to get and stay above the 100 hour MA at 112.58 and the 200 hour MA at 112.663.

The GBPUSD moved to new session highs near the close but found sellers against the 200 bar MA on the 4-hour chart at 1.32308 level. The 200 hour MA at 1.32068 was broken on the way to the next target and is now the close support into the new trading day. IF the buyers want to keep the upside going, get above 1.32308 and the 1.32664 becomes the next target. If the buying is up (may be Brexit related), a move below the 1.32069 (and 1.3200) would likely be the push the market needs.