Forex news for NY trading on March 13, 2018

Intro Paragraph Text Here.

- Major indices end with losses. No new record for the Nasdaq.

- Oil - heads up for the inventory data due around the bottom of the hour

- Trump asked for new China tariffs in the coming weeks

- Bitcoin continues to wait for a push one way or another

- Here is what’s on the economic calendar in Asia today (and a US election!)

- G20 to say standard-setting bodies should strengthen monitoring of cryptocurrencies

- A Pennsylvania's special election loss could put Trump on tilt

- G20 draft communique: One risk to outlook is "a retreat to inward looking policies"

- White House national security advisor H.R. McMaster likely the next to go

- Trump: US is with the UK all the way over spy chemical attack

- 32 years ago today Microsoft launched its IPO: Five crazy facts

- US sells 30-year bonds at 3.109% versus 3.110% WI bid

- White House fires aid who released statement on Rex Tillerson's firing

- WTI crude threatens the trendline since September

- Poloz: Economy may be 50% more sensitive to higher rates than 10 years ago

- 68-year-old Russian tied to spy funding and oligarch found dead in Britain

- BOC's Poloz Q&A: We don't know how the economy would look like without NAFTA

- Italy's Di Maio says he wants nothing to do with European extremist parties

- USDCAD rallies on dovish Poloz comments

- BOC's Poloz: Canada may be able to handle more growth without inflation

- Trump cites Iran nuclear deal as something he disagreed on with Tillerson

- Trump says he looks at Kudlow "very strongly" and he has a "very good chance" at job

- Trump also fired his personal assistant yesterday

- USD falls as Trump tintacks Tillerson

- Trump fires Secretary of State Rex Tillerson

- US February CPI +0.2% vs +0.2% m/m expected

A snapshot of the other markets near the NY session close are showing:

- Gold up $2.88 or +0.22% at at $1326

- WTI crude oil down 73-cents or -1.19% to $60.64

- Bitcoin is trading up $61 at $9081.55. The price is just above the 200 day MA at $9069

- US yields are lower. 2 year 2.254%, -0.8 basis points. 10 year 2.843%, -2.6 basis points. 30 year 3.0997%, -2.9 basis points

- US stocks ended lower with the S&P index down -0.64% and the NASDAQ composite index down -1.02%

US CPI was to be the highlight of the trading day. The data came in largely as expected with a gain of 0.2% MoM and YoY at 2.2%. The ex food and energy also came in as expected (see report here). The dollar moved a little lower on the data.

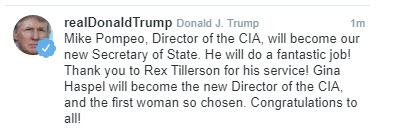

About 10 or so minutes later, a surprise tweet (yes tweet) from President Trump sent the dollar even lower. He announced a shuffle in his cabinet, firing Secretary of State Rex Tillerson, and naming director of the CIA Mike Pompeo as his replacement. PS. Tillerson officially heard about his firing from the tweet.

Apparently, he did not want to leave - especially with all the diplomatic North Korean and China things on the table in the near future. So the announcement was a bit of a blind sided shove out the door. Trump did call Tillerson later in the day at noon, to officially discuss the transition.

To help Tillerson not feel he was singled out, Trump also fired his personal assistant late yesterday (no reason cited) and completed the "sack hat trick" by getting rid of a White House aide who released the statement of the Tillerson firing (The Messenger).

With Cohn resigning last week on the back of the tariffs on steel and aluminum (which were later watered down), the pattern is clear...Nation vs Global and don't disagree (Tillerson calling Trump a "moron" earlier in the administration did not help either). Jobs are in a free fall at 1600 Pennsylvania Avenue.

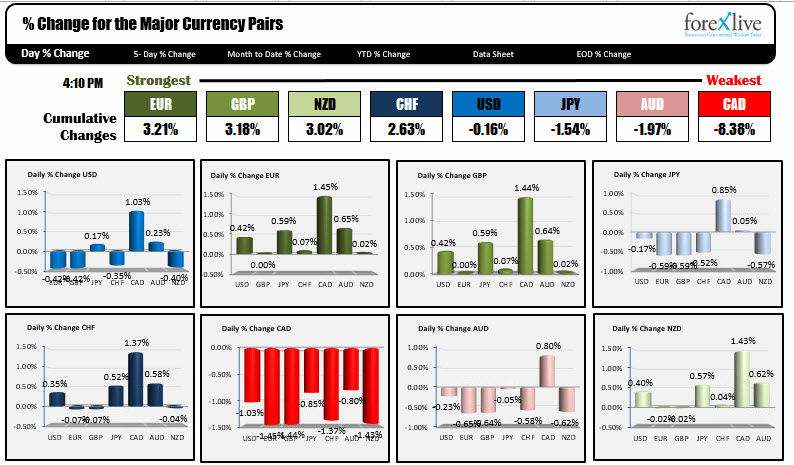

The US dollar was generally weaker falling vs the EUR, GBP, CHF and NZD. It was a little stronger vs the JPY, but well off the pre-data/pre-firing highs.

Against the CAD, the USD actually rose as more dovish comments from BOC Poloz, helped weaken the loonie and make it the weakest currency of the day (by a wide margin). The EUR was the strongest of the major currencies today.

Later in the day, there was a report on Politico that said Trump was to propose tariffs on China good (it is being reported now that he will impose $60B of tariffs on tech and telecom products). That worried the stock market on fears of increasing trading tension and the potential for trade wars. That sent the stocks to lows for the day and completed the Washington focused event day.

I wonder what tomorrow might bring.

Have a good evening/new trading day.