Forex news for NY trading on January 16, 2017

- Carney Q&A: Investment has been dampened by uncertainty

- Germany's Merkel: German economy looking relatively solid

- BOE Carney: BOE can respond in either direction

- Italy's Padoan: Surprised by IMF cuts to Italy GDP forecast

- Banxico central bank Deputy Gov. Guzman: Intervention is FX market remains in toolkit

- Where will the pound be after Theresa May's speech?

- USD/CAD hits session high in thinned out trading

- Monetary policy was key to avoiding catastrophe during the crisis says ECB's Praet

- Northern Ireland elections are likely to be held in early March

- Europe starts the week with red on the ledger

- Goldman Sachs already 1% underwater on Mexican peso call

- IMF economist Obstfeld: Debt presents overhang to world economy

- Theresa May's speech will be at 11:45 am local time on Tuesday

- Trump irks European leaders with prediction others to follow Britain

- IMF leaves 2017 global growth outlook at 3.4% but country forecasts shaken up

- December 2016 Canadian existing home sales 2.2% vs -5.3% m/m prior

- Morgan Stanley intent on buying the dip in the dollar

The NY session was not much of a session. The US markets were closed in observance of Martin Luther King day. So no stocks, commodity, or stock trading. Canada had exiting home sales come out (+2.2% vs -5.3% last month). The IMF kept global growth unchanged at 3.4% but the mix was different. In case you missed it:

- UK growth seen at +1.5% vs +1.1%

- US seen at 2.3% vs 2.2%

- Eurozone seen at 1.6% vs 1.5%

- Italy seen at 0.7% vs 0.9%

- Japan seen at 0.8% vs 0.6%

- Canada unchanged at 1.9%

- India seen at 7.2% vs 7.6%

- China seen at 6.5% vs 6.2%

- Brazil seen at 0.2% vs 0.5%

- Mexico seen at 1.7% vs 2.3%

- Saudi Arabia seen at 0.4% vs 2.0%

It is nice to know but it had limited impact.

BOE Carney spoke later in the day. His comments were part academic and part "nothing really new" . He was after all speaking at the London School of Economics.

The real action in the GBP occurred over the weekend with the gap opening on the hard Brexit speculation. UK PM May will be speaking tomorrow at 11:45 AM GMT. That gap had the GBPUSD opening up at 1.1994. The lowest low extended to 1.19859. The pair closed at 1.2050. So it was higher in intrday trading, BUT the close on Friday was way up at 1.2179 and the low on Friday was at 1.21197. So there is a gap left in it's wake. Needless to say the GBP is the weakest of the major currencies.

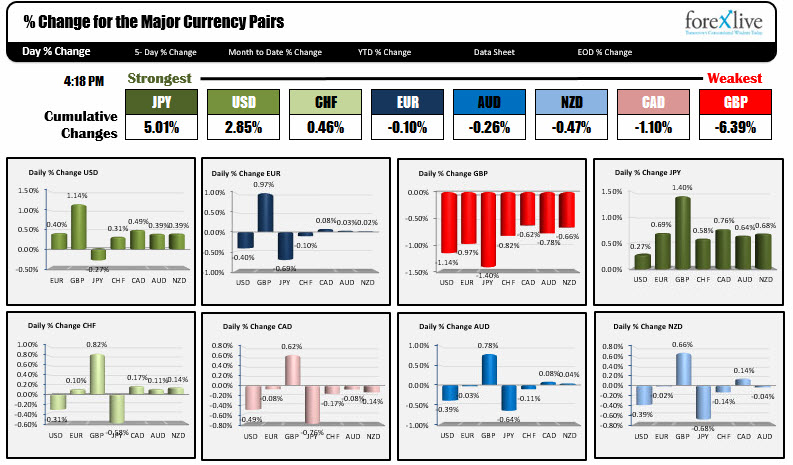

The dollar overall was higher against all the major currencies in trading today with the exception of the JPY (the JPY was the strongest of the majors) but most of the gains were versus the GBPUSD

IN other pairs today.

The EURUSD is ending down on the day and right around the 100 hour MA at 1.0599. The 200 hour MA remains at 1.0577 currently. The combination should be support if the buyers are to remain in control.

The USDJPY took out last weeks lows by a few pips (the low reached 113.60) and ended down on the day, but is 50 or so pips off the lows at 114.15 at the close. Upside resistance at 114.44-54 and the 100 hour MA at 114.85 (and moving lower) are targets.

Below is a snapshot of the strongest and weakest at the end of the NY session.