Forex news for North American traders on November 16, 2020

- Dow and S&P close at record levels

- CFTC commitments of traders: EUR net speculative position remains the largest of the majors

- Biden/Harris speak on the economic recovery. Watch LIVE.

- A third GOP Senator opposes the nomination of Judy Shelton to to Fed Board

- California Gov. Newsom: Orders much of state into most restrictive tier

- US crude oil futures settle at $41.34

- Clarida Q&A: Virus delivered unprecedented economic below in spring

- France reports 9406 new coronavirus cases in 24 hours

- Fed's Clarida: No liftoff until inflation sustained at 2%

- Bitcoin (on Coinbase) gets closer to the January 2018 swing high

- Major European indices close higher

- OPEC+ panel suggests 3-6 month delay to output hike

- More from Fed's Yellen: No conflict between the Fed's dual goals of jobs, inflation

- Janet Yellen: Central banks have it done a good job responding to crisis

- EU envoys fail to reach required unanimity on recovery fund

- Canada Sept manufacturing sales +1.5% vs +1.5% expected

- November Empire Fed +6.3 vs +13.5 expected

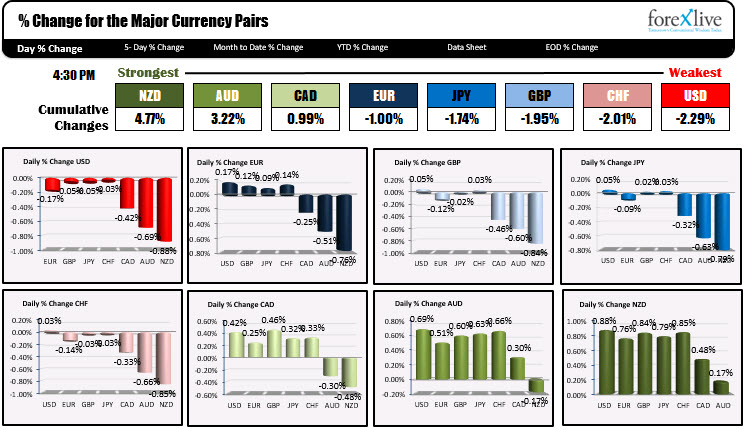

- The CAD is the strongest and the JPY is the weakest as NA traders enter for the day

- New Jersey set to announce new restrictions on indoor, outdoor gatherings

- Moderna reports that coronavirus vaccine found to be 94.5% effective

A look at some of the other markets heading into the close for the day:

- Spot gold is trading down $0.17 or -0.01% at $1889.04. The Price action has been volatile with the pair rising as high as $1899.15 and trading as low as $1865.30.

- Spot silver is up $0.13 or 0.53% at $24.80

- WTI crude oil futures settle up $1.36 or 3.39% $41.49. The high reached $42.09. The low extended to $40.15

The big event today was the news that Moderna's covid drug was 94.5% effective. That surpassed the Pfizer's drug which was 90% effective. Good news for Covid, although it will still be months before a more meaningful distribution. Meanwhile, the covid statistics continue to march higher with hospitalizations at record levels in the US.

Nevertheless, the news propelled stocks higher in what was a soft data day (only Empire manufacturing index was released with the index coming in weaker at 6.3 vs. 13.5 estimate). The Dow and S&P both closed at all time record levels. The Dow closed just 50 points or so from the 30,000 milestone. For the year, the S&P is now up 12.26%. The Dow is up 4.95%.

The final numbers are showing:

- Dow rose 470.63 points or 1.6% at 2995.44

- S&P rose 41.76 points or 1.16% at 3626.91

- Nasdaq rose 94.84 points or 0.80% at 11924.13

In the US debt market, yields moved marginally higher with the yield curve steepening:

- 2 year 0.177%, unchanged

- 10 year 0.907%, +1.1 basis points

- 30 year 1.663%, +1.5%

In the forex market today, the NZD is the strongest followed by the NZD as flow of funds went into the risk/commodity currencies. The USD and CHF were the weakest as investors shed the safety of those currencies.

Some technical levels going into the new trading day:

- EURUSD opened the NY session at session lows and at the lows approached the converged 100 and 200 hour MAs at 1.1811. The buyers pushed the price higher and was able to get above a swing area topping out at 1.1843. The next target is the swing hi from November 5 and swing low from November 9 at 1.18592 (current price is at 1.1850). Above that will target the high for the day at 1.18682. A move below the 1.18342 would put a bit of a negative tilt in the short-term. However it would take a move below the 200 hour moving average 1.18162 and the 100 hour moving average at 1.18113 to tilt the technical bias more to the downside.

- GBPUSD: The GBPUSD trade above and below its 100 hour moving average during the last 6 hours of the new trading day (at 1.31939). Admittedly, the price moves above the line were only 3-5 pips above but let's just say, the sellers could not keep the pressure on the pair. Nevertheless, the new day will center around at moving average at 1.31939. Move above is more bullish. Stay below is more bearish with the 200 hour moving average 1.31598 (and rising) as the next target to get to and through.

- USDJPY: The USDJPY moved lower into the European session, then shot higher into the New York session only to run into the 100 hour moving average (currently at 105.024). The subsequent fall to the downside did not quite reach the early European lows near 104.361. The low price reached 104.48. However, the pair is closing below its 200 hour moving average at 104.613. Most of the New York session stay below that level. The 200 hour moving average would be the barometer for the buyers and sellers into the new trading day.