Forex news for North American trading on June 29, 2021.

- S&P and NASDAQ close at a record high

- Is the yen's undervaluation justified? What's next? - BofA

- WTI crude oil futures settle at $72.98

- OPEC monitoring committee meeting delayed until Thursday in schedule reshuffle

- OPEC+ JTC keeps 2021 global oil demand growth at 6 million barrels per day

- European indices close the day higher

- Dallas Fed service sector index 36.2 vs 40.0 prior

- US June consumer confidence 127.3 vs 119.1 expected

- Not a good look as gold falls through the post-Fed low

- Fed's Barkin: Inflation and growth will peak in Q2

- US April FHFA home price index +15.7% vs +13.9% y/y prior

- US Case-Shiller April 20-city house price index +14.9% vs +14.5% y/y prior

- OPEC's Barkindo: OECD oil stockpiles are now below 2015-2019 average

- The JPY is the strongest and the AUD is the weakest as NA traders enter for the day

- US consumer confidence and housing data coming up

The housing data from the Case Schiller for April continue to show stronger again zero year. The case Schiller index of 20 cities showed a 14.9% year on year gain. The FHFA price index rose 15.7% year on year. Both are higher than the previous month. US consumer confidence for June also showed a sharp rise to 127.3 from 117.2 last month.

Good data helped to keep the USD bid. For the 2nd day in a row, the JPY was the strongest of the major currencies while the USD was just behind it as the 2nd strongest. The AUD was the weakest of the major currencies. Yesterday, the NZD was the weakest.

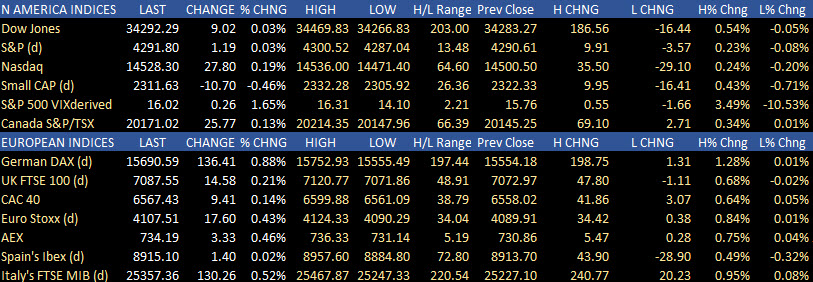

Stock price also closed higher with the S&P and NASDAQ closing a new all-time record highs but not by much. The Dow industrial average and S&P index each rose by 0.03%, while the NASDAQ index gain 0.19%. That was off their intraday high of 0.54% for the Dow, and +0.23% for the S&P. The NASDAQ fared better as it headed intraday high of 0.24% (and a low of -0.20%). . European shares today close higher across the board with your index up 0.88%. Italy's FTSE MIB ended up at +0.52%. Below are a summary of the percentage changes and ranges for the major North American and European indices.

In other markets today:

- Spot gold is down $-19.10 or -1.07% at $1761.06. it's high price reached $1779.15 while its low extended to $1750.02.

- Spot silver is down $0.35 or -1.35% or $25.87. The high price for the day reach $26.21, while the low extended to $25.61

- WTI crude oil futures are trading at $73.44 that's up $0.53 or 0.73%.

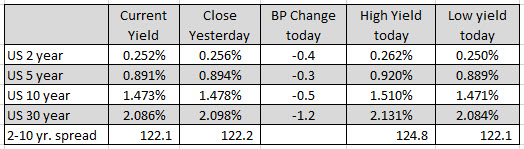

In the US debt market, rates were lower across the board with the 30 year yield moving the most that -1.2 basis point. The 10 year note remains below 1.50% level after an earlier rise to 1.471% stalled.

Some technical levels into the new trading day:

- EURUSD. The EURUSD for the most part stay below its 200 hour moving average at 1.19166 (and moving lower). The pair is trading at 1.1896 near the close. It will take a move above the 200 hour moving average at 100 hour moving average ( currently at 1.19264) to tilt the technical bias more to the upside. On the downside moving below 1.18803 (swing low from June 22), would open the door for a retest of the June 18 and June 21 lows between 1.1845 and 1.1850.

- GBPUSD The GBPUSD moved into the lower extreme area for the month of June between 1.3785 and 1.3831 but could not stay below the higher extreme at 1.3831. The price is currently trading at 1.38390 after rising to a New York session high of 1.3853. That high keeps the sellers more in control (it represents the bottom of a swing area between 1.3853 and 1.38708). However a break below 1.38283 (and staying below) would be needed to increase the bearish tilt in the new trading day. Stay below and traders would target the swing low from June 21 at 1.37856 as next key target.

- USDCAD: The USDCAD moved above its 100 day moving average in the last few hours of trading. That moving average in the new trading day comes in at 1.2392. The price is currently at 1.2399. If the price can stay above the 100 day moving average and get and stay above the swing high from June 22 at 1.2402, the technical bias would be in the favor of the buyers.