Forex news for North American trading on August 31, 2021.

- US stocks close lower. First decline in the S&P/Nasdaq in three trading days

- Pres. Biden to speak about Afghanistan

- U.S. Treasury says Social Security old-age and survivor insurance trust fund depleted by 2033

- Canada 2021 GDP now expected to be 'well below' 6%

- USD moves higher vs all the major currencies with the exception of the NZD

- WTI crude oil futures settles at $68.50

- European equity close: Soft finish but a positive month

- ECB's Knot: Practically all the incoming news has been a surprise on the upside

- Dallas Fed August service sector index 16.5 vs 21.7 prior

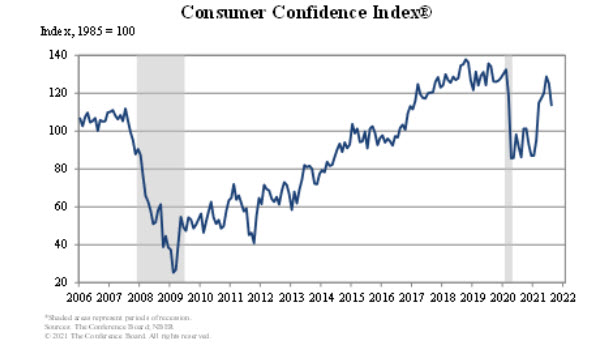

- US August consumer confidence 113.8 vs 124.0 expected

- US June FHFA house price index 18.8% y/y vs 18.0% prior

- US June Case-Shiller 20-city price index 19.1% y/y vs +18.5% expected

- Canada June GDP +0.7% vs +0.7% expected

- The NZD is the strongest and the USD is the weakest as the NA session begins

August is in the books.

In the forex, the USD was mostly higher (the exception was against the NZD). The NZD was the strongest The CHF, GBP and CAD were the weakest.

The major US indices traded higher with the Nasdaq leading the way with a near 4% gains for the month. The S&P index rose for the seventh consecutive month:

- Dow, rose 1.23%

- S&P, rose 2.92%

- Nasdaq rose 3.98%

In the European equity markets this month:

- German Dax, +1.87%

- France's CAC+1.02%

- UK's FTSE +1.24%

- Spain's Ibex +1.97%

- Italy's FTSE MIB+2.55%

In the US debt market, yields are higher for the month of August:

- 2 year moved from 0.174% to 0.2093%

- 5 year one from 0.655% to 0.778%

- 10 year one from 1.178% to 1.312%

- 30 year went from 1.849% to 1.929%

In major commodities for the month of August:

- Gold is unchanged

- Silver fell -6.29%

- Copper fell -2.5%

- WTI crude oil fell -7.22%

In the markets today, the the US consumer confidence came in at its lowest level since February at 113.8 versus 124.0 expected. Although lower it still remains relatively elevated, but it joins other sentiment indicators like the Michigan Consumer Sentiment indicator in signaling a weakening of the trend.

Looking at the forex markets today, the USD was lower to mixed with the largest decline vs the NZD . The green back also fell vs the AUD, CHF and EUR, but had modest gains vs teh CAD, JPY and GBP on the day.

Looking technically at some of the pairs going into the new trading day:

- EURUSD; The EURUSD is closing above the 1.1800 to 1.18004 swing area at 1.1808, but is below the 61.8% at 1.18146. The high price reached in the early NY session squeezed up to 1.1839. That was the highest level going back to August 5. However, dollar buying into the London close sent the pair quickly to the downside and back below before bouncing the 1.1800 level to 1.1796 before bouncing. The 1.1800 will be the early barometer for the buyers and sellers. Stay above is more bullish. Move below and the sellers could be seen pushing for a test of the 100 hour MA at 1.1875 (also the 50% midpoint)

- GBPUSD: The GBPUSD is closing near the rising 100 hour MA at 1.3747. The 100 hour MA is also where the 38.2% of the move down from the July 30 high is found. That level will be the bullish/ bearish barometer into the new trading day. Move below and traders will make a run toward the 200 hour MA at 1.37133. Move below it and the sellers take more and more control. On the topside, the 200 day MA at 1.38043 is a key target. The 1.3790 to 1.38043 is the key resistance area.

- USDCHF. The USDCHF is closing right around the converged 100/200 hour MAS at 0.9158. Those MAs will be the bullish bearish bias barometers in the new trading day.