Forex news for North American trading on February 5, 2021

- Stocks end a solid week with gains today

- CFTC commitments of traders: EUR long position trimmed but still the largest speculative position.

- Not a lot of key data next week

- WTI crude oil futures settle at $56.85

- US House approved budget package. Paves way for Biden Covid 19 aid plan

- WH Presser: There is still time for bipartisan work on stimulus

- Bakers Hughes oil rig count 299 vs 295 last week

- Merkel: Planning to extend Germany's lockdown by two weeks

- Biden says he is not cutting the size of the stimulus checks

- European shares end mixed. Italy, Spain leads the way this week

- WH Econ. Boushey: Aid to families absolutely necessary

- Atlanta Fed GDPNow Q1 forecast 4.6% vs 6.0% prior

- Canada January Ivey PMI 48.4 vs 46.7 prior

- Canadian dollar shakes off soft employment report, hits session high. Key on CAD/JPY

- The GBPUSD chops higher and continues the chop that the pair has been stuck

- SNB's Jordan says he sees little value in forward guidance

- US December trade balance -66.6B vs -65.7B expected

- Canada international merchandise trade $-1.67 billion billion vs. $-3.0 billion estimate

- US January non-farm payrolls +49K vs +105K expected

- Canada net change in employment -212.8K vs. -40.0K estimate

- The CAD is the strongest and the NZD is the weakest as NA traders enter for the day

It was unemployment day in the US and Canada, and both reports came in weaker than expectations:

- US nonfarm payroll rose by 49K, which was less than the 105K expected. However the prior to month revised down -159K. The unemployment rate did fall fairly sharply to 6.3% from 6.7%, but the decline was attributed to workers leaving the workforce. The participation rate came in at 61.4%. It was at 62.8% prior to the pandemic.

- Canada saw net change in employment of -212.8 K vs. -40.0 K. However, most of the decline was as a result of the restrictions being put in place shortly after the December report in Québec and Ontario. Also full-time jobs increase marginally while nearly all the declines were in the part-time jobs.

The decline in jobs sent the US dollar lower after the greenback tried to base and rise this week - at least against some of the currencies. The dollar fell the most vs. the AUD (-0.96%), the EUR (-0.7%), and NZD (-0.67%). It felt the least verse the JPY (-0.15%).

As for the Canadian dollar, the weaker Canada jobs data saw the loonie weaken initially, but quickly reversed, and is ending near session lows for the day.

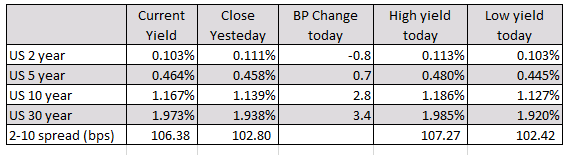

In other markets, US yields initially moved lower across the yield curve, but has since seen a reversal back toward the highs for the day in longer dated yields as investors expect the Fed to remain accommodative, new Biden stimulus to add more growth. Yields are expecting more inflation down the road, but shorter-term yields to remain low.

The 30 year yield is trading at 1.973% after peaking at 1.985% earlier in the session. The 10 year yield is at 1.167% which is off the high of 1.186% but well off the low at 1.127%. Next week the US treasury will auction off 10 and 30 year issues. With US yields at higher levels, there should be good demand but the trend toward a steeper yield curve continues. On the other end of the yield curve, the 2 year is trading near and at all-time low levels of 0.103%. As a result, the 2 – 10 year spread is up to 106.38 from 102.80 at the close yesterday.

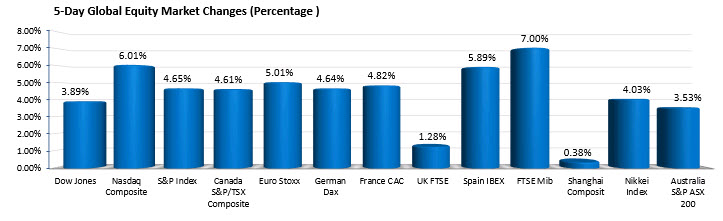

In the US stock market, the major indices capped a strong week to the upside with gains today. The S&P and Dow industrial average close higher on each day this week. The NASDAQ index had one blip to the downside but 4 other days were higher. The biggest gainer was the Russell 2000 which rose by 7.59%. The NASDAQ index tacked on 6.1% this week and is up 7.51% this year. The S&P index rose by 4.65% and is back in the black for 2021 at 3.48%. The Dow industrial average increase by 3.89% today and is higher by 1.77% year to date

European shares also advance this week with Italy's FTSE MIB increasing by 7% as market participants cheered the prospects of a Draghi government.

- Gold prices rebounded off of the lowest level since December 1 yesterday at $1785. The price today rebounded by about $16.80 to $1810.83. Last Friday, the price settled at around $1847. The high price on Monday reached up to $1871 before rotating to the downside into Thursday's low.

- Spot silver is is trading up $0.50 at $26.85. Last Friday the contract settle your $26.98 and Higher to a high price of $30.10 on Monday. However on Tuesday the price was back down toward the Friday closing level and the contract waffled up and down into the close today. The low price on Thursday reached $25.90.

- The price of crude oil futures closely gains on each day this week. The low on Monday was at $51.64. On Tuesday the price cracked above the January ceiling at $53.94. Today the high price extended to $57.29 which was just short of the January 2020 high price for the contract at $57.41

Wishing everyone a happy and healthy weekend. On behalf of the my colleagues thank you for your support.