Forex news for NY trading on September 7, 2018

- US stocks end lower. Nasdaq worst week since March 23rd.

- Apple says proposed tariff list covers a wide range of Apple products

- CFTC Commitments of Traders: EUR the only long position. GBP shorts remain the largest short.

- Fed's Kaplan: Won't need to make a judgement on rates becoming restrictive until mid-2019

- US crude oil settles the week at $67.75. Near unchanged on the day.

- Trump: We are working on a deal with Canada, we will see if it's good

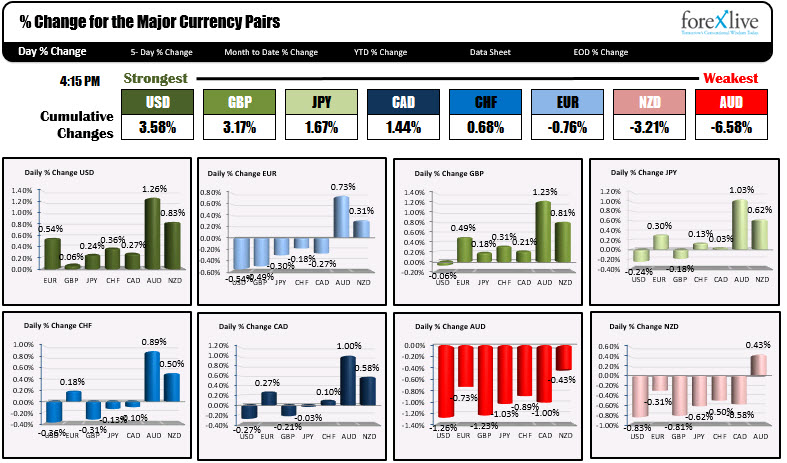

- The strongest and weakest in the forex market this week.

- Freeland: Meeting on NAFTA with US was constructive

- Fed's Kaplan: Would not surprise me if US-China trade war lasts years

- Fed's Kaplan: Unemployment rate will probably go lower than current 3.9%

- Baker Hughes US weekly oil rig count 860 vs 862 prior

- Trump: US is beginning trade negotiations with Japan. On Canada "we'll see what happens"

- Trump: Another $267B China tariffs ready to go after $200 already announced

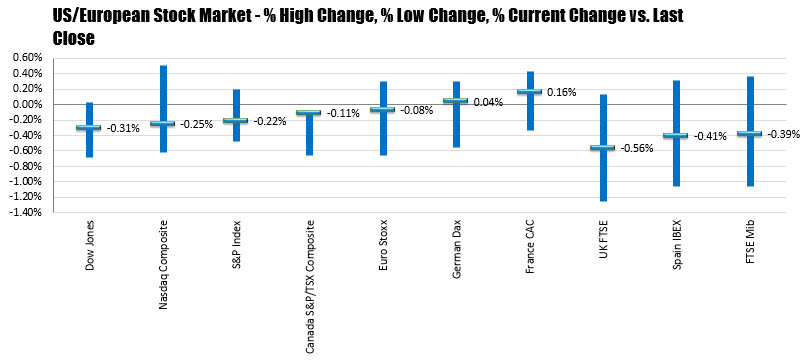

- European equity close: UK lags to end a tough week

- NY Fed Q3 GDP Nowcast rises to 2.2% from 2.0%

- Fed's Mester: 'Pretty strong' jobs report supports continued gradual hikes

- Barnier: We are determined to work for orderly withdrawal

- Fed's Kaplan: Jobs report is consistent with view of strong economy

- Canada Ivey PMI for August 61.9 vs 61.4 estimate

- Kudlow says 'mildly optimistic' about Trump talks with Juncker

- It's all about anticipation ...

- Jobs double-whammy for USD/CAD as it rises to 1.3175

- US August non-farm payrolls 201K vs 191K expected

- Canada August employment -51.6K vs +5.0K expected

- The GBP is the strongest. The AUD is the weakest before the Employment reports

In other markets:

- Spot gold is down -$3.39 or -0.29% at $1196.50

- WTI crude oil settled the week at $67.75. CLICK HERE

- Bitcoin had a quieter day today (after a couple days of big declines). The digital currency is trading down -$17.61 at $6425. The price fell back below the 100 day MA this week at $6871.51. That level is now a risk defining level for shorts.

The US stock indices ended the day lower today. European shares were mostly lower although the German Dax and France Cac ended the day with small gains.

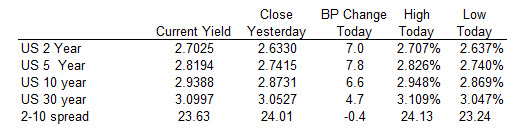

The US debt market is ending with sharply higher yields with the yield curve flattening a bit after the solid US jobs report. The 2-10 spread - which dipped below the 20 bps level last week - narrowed by 0.4 bps to 23.6 bps.

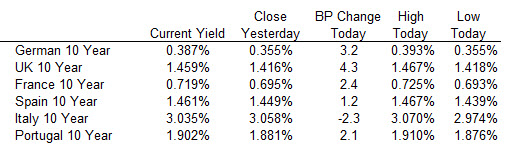

In the European debt market, the benchmark 10 year yields ended the day with mostly higher yields.

The USD is ending the day as the strongest currency. It also was the strongest currency of the majors for the trading week as well (see post here). The weakest currency today was the AUD (lowest level since early 2016). The NZD was also weaker. Those currencies were also the weakest for the week. The day ended with the same theme as the week.

The major catalyst for the day was the US employment report. Highlights included:

- Non Farm payroll rose 201K vs 191K expected.

- 2-month payroll revision -50K

- Hourly wages 0.4% vs 0.2% exp..

- Wages YoY 2.9% vs. 2.7% exp. Best YoY vs 2009.

- Private payrolls 204K vs +194K expected

- 3 month average NFP 185K

- Prior private payrolls 170K (revised to 153K)

- Manufacturing -3K vs +23K exp

- Unemployment rate 3.9% vs 3.8% expected

- Prior unemployment rate 3.9%

- participation rate 62.7 versus 62.9 last

- Hours of work. 34.5 vs 34.5 last

You could nit-pick about the revisions. You can look at the unemployment rate moving to 3.9% vs 3.8% expectations. However wages came in better than expected, and that was the main catalyst for a higher dollar and expectations that 2 more hikes (one later in September and one in December) is likely.

Another benefit to the dollar was the aversion away from the AUD and NZD. Although Pres. Trump did not announce that the next $200B of tariffs on China goods was officially starting (the comment period ended yesterday), he did "see the $200B, and raised the tariff target an additional $267B" (see post here). That would bring the total just of $500B which is about the total of China exports to the US.

A weaker China economy, as a result of the trade war (and potentially weaker global economy), is not good new for Australian and New Zealand who rely on exports to China for some of the GDP growth. As a result, most of the dollar gains has its roots in those two currencies today/this week.

Both the AUDUSD and the NZDUSD traded to new 2018 lows. For the AUDUSD, the pair moved below the 0.7144-59 swing lows from May and December 2016, and broke below a lower trend line at 0.7156 on the weekly chart (see post here. The NZDUSD made new lows for the year - taking out Wednesday's low of 0.6529 by 6 pips (low reached 0.6523). That break did not solicit much momentum, which is a concern, but if the August 15 low (old low for 2018 before this week) can keep a lid on the pair, the sellers remain in control.

The EURUSD was also pressured today (down -0.54%) and is closing near the lows for the day at 1.1522. For the the week, the pair is lower (closed last Friday at 1.1599), but there was a number of ups and downs along the way. The low was reached on Tuesday at 1.1529. The high was on Thursday at 1.16588. Today, the employment report sent the price below the 100 hour MA at 1.16037, and below the 50% of the week's range at 1.1594. The high corrective price stalled just short of that midpoint level. That is always a little more bearish

The USDJPY bottomed in the Asian session after failing on a break below the 100 day MA at 110.49 (low reached 110.374 and bounced back higher). The high reached the converged 100 and 200 hour MAs (and other levels) at the 110.19-23 area where sellers leaned. Pres. Trumps comments on $267B of more tariffs put the kabosh on that rally and the price moved back off. The 100 day MA below and the 100 and 200 hour MA above will be the trading guardrails next week.

Speaking of the USDJPY, I used the price action in the pair this week for my recent video titles, "It's all about anticipation". Take a look at it this weekend and share your feedback.

Wishing you all a great and safe weekend.