Who is the audience?...

We conducted the 2016 ForexLive Customer survey and first off, we want to thank all who participated. I have left the survey open, if you did not get a chance to participate. I/we will not be bother you anymore, however. Yippee!

From the results, we have a better understanding of who you are, what are your needs and we hope to be able to address most of those needs (if not all) going forward. So thank you for helping us, help you.

Surveys have a level of statistical errors associated with them of course. However, they should give an overall view of the surveyed, as long as the number of responses are statistically relevant. I am confident that we have a good enough sample.

The survey had simple multiple choice questions, and others that provided an opportunity for you to post a question or comment. The "question/comments" will be answered over time- some directly via email and others here on the FXL website.

I will bucket posts about the survey in the "Education" section of the website for easier reference. I will use "ForexLive trader survey" in the title, to better compartmentalize the results, general answers to questions/comments and interpretations.

Regarding the questions, if you do not get a direct response it may be because there may not have been an email entered directly with the question. So if you have a question that you want answered, you can send it to me directly at greg@forexlive and I (or someone else) will answer.

Anyway, Question 1 was a simple one:

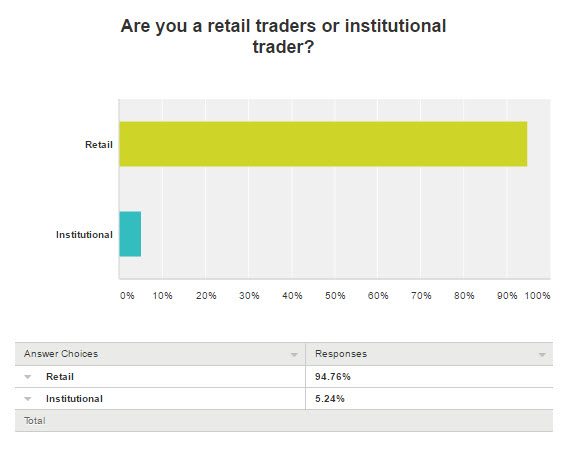

Are you a retail trader or institutional trader?

The overwhelming number are retail traders - with nearly 95%.

Am I that surprised?

Not really. First there are a ton more retail traders out there in world. When I was in the retail world there were > 10,000 accounts - that was at one broker. When you think of the institutional market, there is a lot less traders.

Also, lets remember, institutional traders have all the services that keep them informed. They are connected. They by and large are responsible for the moves. They help tell the story that the retail traders want to know. In addition, they are where they are for a reason. They have done all the heavy lifting needed to perform their jobs.

Having said that, they do tune in. Adam even has a t-shirt from SF Fed's Williams. So although the number is a lot lower, we should not underestimate the breadth of readership at FXL. It is pretty wide but as far as pure numbers, retail traders are the much larger number.

The next question, tried to qualify those traders by asking for the years of experience. The majority of traders surveyed (53.36%) have been trading forex for greater than 3 years. Newbie (<1 year) and New borns (demo traders) make up about 17.3% while 29.3% are greater than 1 year but < 3 years.

So the audience is a little more seasoned than what I would have expected.

Knowing who are audience is and understanding their experience is important to us. Although, 3-years may seem like a long time and you may have "Survived", the path to survival, is likely filled with pot holes that needed (or may still be needed) to be filled.

When do most trader trade? The majority are trading during the European/London session. Of course that overlaps the NA/New York session making the NA morning hours the most important time of the day for traders. This would be consistent with trading in general...now at least.

In the past (pre 2008), the NA participation might have been greater. However, increased regulation in the US has led to a contraction of retail forex trading. That has likely led to a smalller number of participants.

Being predominantly a retail crowd, I think what we do each day at FXL, is for the most part geared to our audience with the understanding you cannot satisfy all the people, all the time. Nevertheless, we bring a professionalism that is satisfying to the institutional crowd as well.

Feel free to comment on the results. More to follow tomorrow....