Here's why whatever decision or language the BOE signals won't matter

The BOE meeting is the big focus in trading today, and rightfully so. It would be quite a shock if the central bank moves to raise rates later considering the type of start the economy experienced in Q1 - ill weather or not.

The two main things to look out for in the meeting later will be the committee votes and the inflation report.

For the votes, it'll be interesting to watch if we get any further change from the 7-2 that we saw previously. A nudge higher in those opting for a rate hike will mean that members are viewing that the slowdown in Q1 is likely transitory and the central bank is ready for an August hike (bullish sterling). A nudge lower means a rethink in those expectations and that means a decision in August is still very much up in the air (bearish sterling).

Meanwhile, the inflation report and the BOE's language towards the soft patch in Q1 will be key. Watch out for the GDP forecast that is to be released. That will set the tone on how the central bank views the economy this year after the poor start in the first quarter. If the BOE remains defiant that the economy will bounce back, then the market will be looking towards August for the next move (bullish sterling). But if the BOE acknowledges the slowdown and says that the next move will be data dependent, then that leaves room for uncertainty going forward (bearish sterling).

But regardless of whatever they say, it doesn't really matter. What matters going forward are economic data points themselves.

Citi's economic surprise index shows that UK data until Q1 has disappointed heavily, reaching its lowest level since 2012. So, even if the BOE remains upbeat or bullish about growth prospects this year, it's not going to help if economic data continues to underwhelm in Q2.

We've already had an early taste of poor consumer readings in April here. And if that streak continues then I don't see how the BOE can angle the market towards a rate hike in August - even if inflation allows for it.

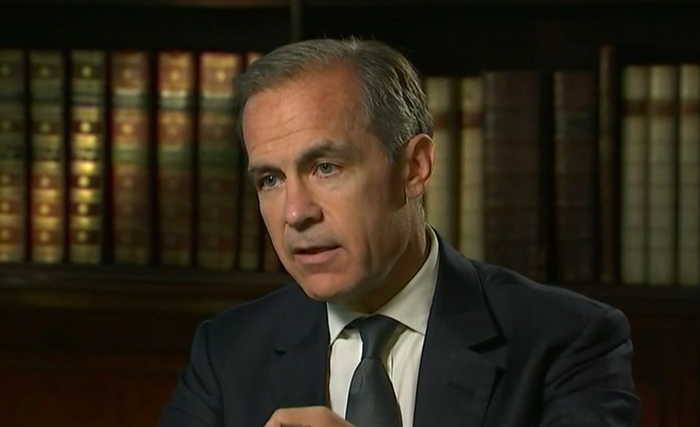

As much as the central bank would like to get it over and done with, at the end of the day it needs to rely heavily on economic data to support its case. We've all already seen how bad economic data can take away the market expectation of a rate hike in April, so if Carney & co wants to move forward with plans to raise rates in August or some time this year - the first thing they need is more positive momentum from economic data releases.