It's all about equities

Bank of America Global Research notes that the most important question for FX right now is whether the equity market rally continues or not.

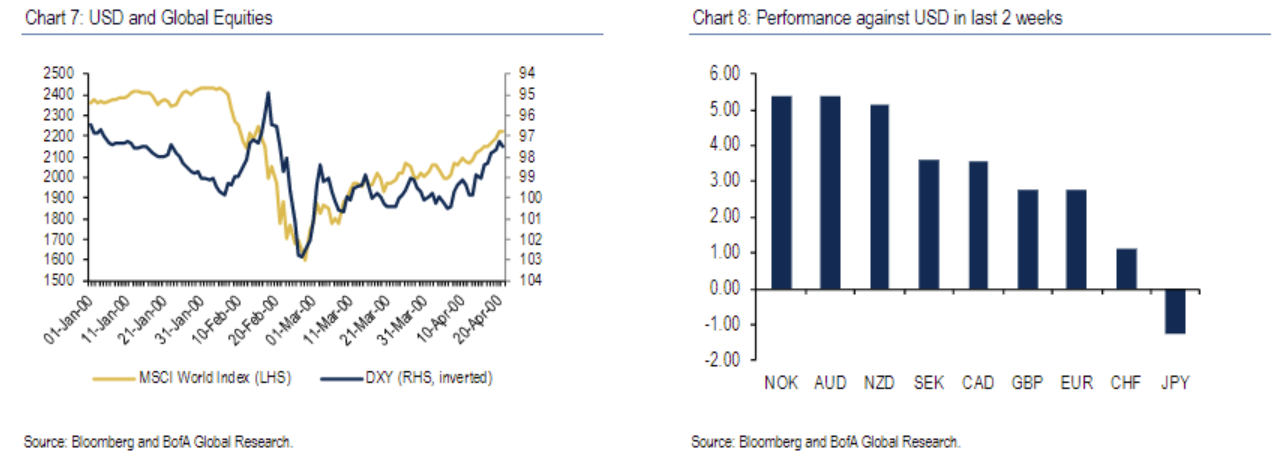

"Will the market rally continue? Despite collapsing data during the lockdown and the worst global recession since the great depression of the 1930s, global equities (MSCI world index) are up by an impressive 39% since the bottom of March 23. They are up by 7.3% just the last two weeks. They are still down by 5.8% for the year, but this seems very little to us given the severe recession," BofA notes.

Whether the market rally continues or not we believe is the most important question for FX right now. In Has FX lost its touch? we argued that risk sentiment is the most important driver in FX today. Chart 1 shows a strong correlation of DXY with global equities. DXY is down by 5.1% since it peaked on March 20, half of which took place in the last two weeks, as the equity market performance accelerated-DXY is up by only 1.2% so far this year. Focusing on the last two weeks, the strongest performers in G10 are the high beta currencies (Chart 2). The evidence suggests to us that FX and equities are effectively the same trade. If equities keep going up, the USD will keep going down," BofA adds.