Goldman Sachs on the escalating trade war, they expect the next shots to be fired real soon

(bolding is mine)

Based on our statistical analysis and in light of current market conditions, we argue that investors concerned about a worse-than-expected outcome for the US-China trade disputes should:

(i) sell USD/JPY,

(ii) buy USD/KRW,

and (iii) remain tactically cautious about high-beta EM FX, even for currencies outside the region.

Long JPY/KRW would likely be the cleanest tail risk hedge consistent with our views.

The public comment period for the Trump Administration's proposed US$200bn in additional tariffs on China ends later today. While a number of details are uncertain, our Washington team expects the White House to move forward with these tariffs, imposing a rate of 10% on consumer goods and 25% on other (industrial/intermediate) products.

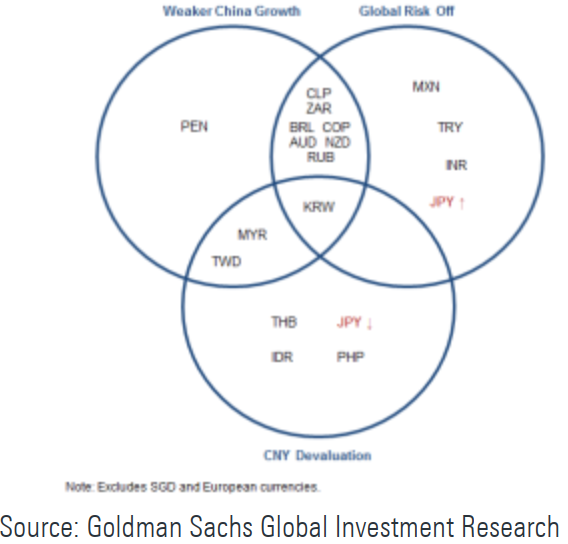

As we detailed in earlier analysis, tariffs on China can affect FX markets through three main channels:

(i) by lowering expectations for Chinese growth,

(ii) by causing a general decline in risk tolerance and therefore weakness in riskier currencies,

and (iii) by weakening the Chinese Yuan relative to the US Dollar.

The note is detailed, but I just wanto highlight this …. I think they might be takin' abuot the AUD, whaddya reckon?

- Each of these channels has different implications for currency markets (Exhibit 1). In particular, weakness in Chinese growth expectations tends to affect currencies with close economic ties to China, especially its regional neighbors and certain commodity exporters.

Yeah, lookin at you AUD!

ps. President Trump speaks very soon (0100GMT) …. China tariff announcement?