GS on the Australian and New Zealand dollars against the euro, citing China growth bottoming out

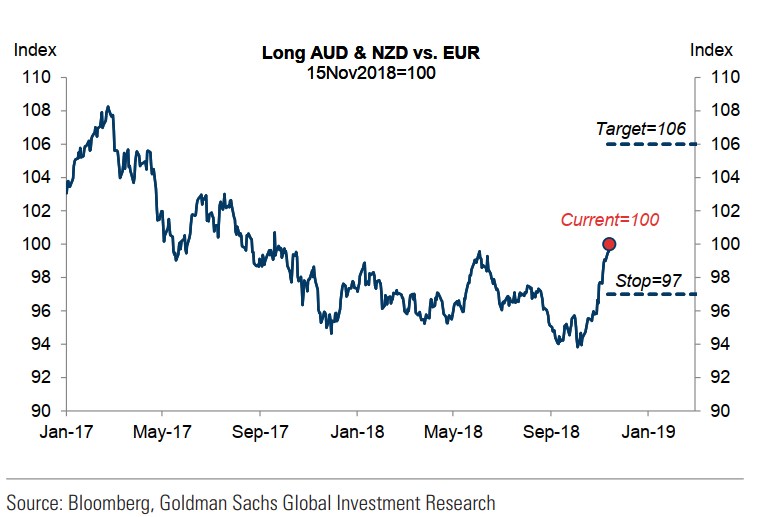

From a late-week note, the bank likes long AUD and NZD vs. EUR, citing:

- Despite strong domestic fundamentals, AUD has weakened in lockstep with other EM assets this year against a backdrop of China slowdown concerns

- NZD has faced similar headwinds, as well as additional jitters around political tensions and a more dovish perception of the central bank

- Now, with China growth bottoming out and domestic inflationary forces starting to build, we think there is room for a rebound

- We recommend funding the trade out of EUR, where a confluence of political risks and growth concerns is likely to cap performance over the next few months and carry is attractive