Goldman Sachs are bullish on oil, saying their price target has upside risk

- Geopolitical risk has been top of mind as President Trump announced that the US would withdraw from the Iran nuclear deal. The address was more hawkish than expected, with the US Treasury advising that countries seeking an exemption once the sanctions become effective in November start reducing their purchases immediately.

- Our Commodities team estimates that renewed sanctions could put 250-500kb/d of exports at risk, which could support oil prices by $3.5-$6.2/bl should other producers not respond; Saudi Arabia however indicated that it would work to mitigate the impacts of supply shortages and support market stability.

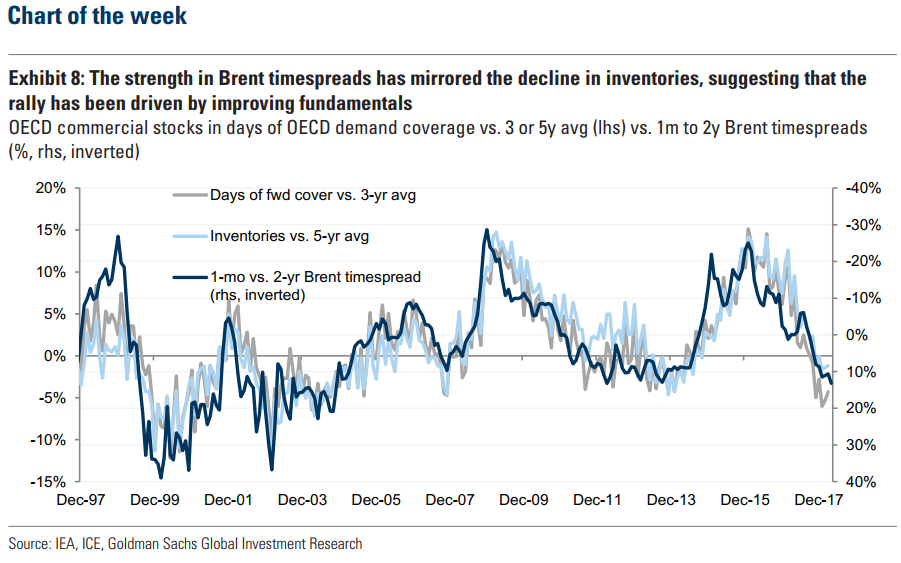

- Despite an increased geopolitical risk premium, our Commodities team sees the oil price rally primarily driven by improving fundamentals - inventories are now well below the 5-year average under any metric and they expect continued draws through year-end, increasing upside risks to our $82.5/bl summer oil price target.