Preview of the retails sales and the NY Federal Reserve Empire State Manufacturing Survey

Its a busy morning coming up for US markets, with some politics to kick it off:

Later, due at 1230GMT (8.30am US east coast time) …

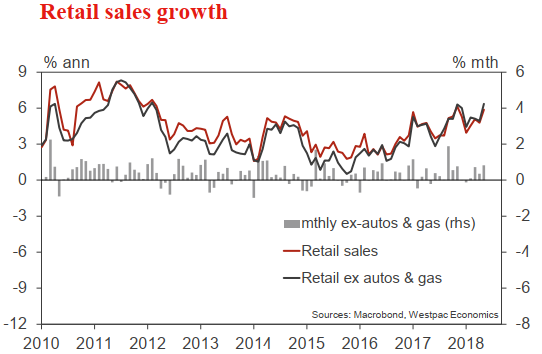

Retail sales for June

- expected is 0.5%, prior 0.8%

- excl auto expected 0.3%, prior 0.9%

- exl autos and gas expected 0.4%, prior 0.8%

Preview from Westpac:

- Retail sales surprised in May, the 0.8% headline gain double the market's expectation. The Apr outcome was also edged higher to 0.4%. Highlighting the breadth of the sales gain, excluding autos & gas, May activity was also up 0.8%, while the control group gained 0.5%.

- Come June, a similar result is likely. We forecast a 0.7% rise in total sales, and circa 0.5% for core retail. Importantly, this does not mean we are expecting a strong Q2 consumption print when GDP is released in a few weeks time.

- Also available to May, the broader personal consumption data makes clear that total consumption (including services) has been weaker than retail sales of late. And also, that once deflated for inflation, spending growth in Q2 has only been a little stronger than the weather-affected Q1.

--

New York Fed Empire State manufacturing survey for July

- expected 21.0, prior 25.0

Preview via Nomura:

- Incoming survey data suggest that continued business expansion, driven by strong domestic demand, may have outweighed increased risk from trade uncertainties. In particular the June ISM manufacturing survey signaled steady business expansion although supply disruptions appear to have worsened in part due to protectionist trade policies.

- While we think that the July estimate of Empire State index will reflect this ongoing strength, we forecast a reading of 19.0 to reflect potential impact from supply constraints, partly worsened by trade uncertainties. However, this is still an elevated reading, which would be consistent with recent strong readings of new orders and production indices.