It is a busy US data docket coming up later, with Retail sales for March at 8.30am NY time (1330GMT)

- The New York Fed Empire State manufacturing survey for April. also at 8.30am NY time (1330GMT)

- April NAHB homebuilder survey, 10AM NY (1500GMT)

- Business Inventories (February), also at 10AM NY (1500GMT)

Retail sales is the focus.

Preview via Westpac

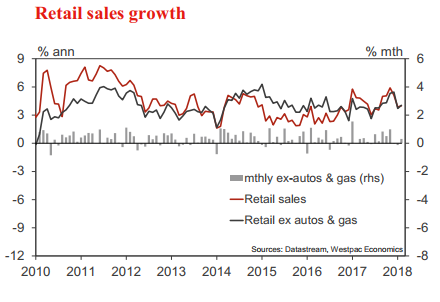

- US retail sales have continued to disappoint through Q1 2018. In the February report, a third consecutive negative was recorded for total sales.

- It is certainly the case that one-off factors have been at play: auto sales continue to come back to a more normal level after their hurricane-induced spike in late 2017; also abnormally cold weather in February weighed on gasoline and store sales as consumers stayed home. However, a surge back in Mar is highly unlikely.

- Evident in the income and savings data in recent months is that real wages growth (excluding the tax cuts) remains soft, and household savings low versus history. These restrictions on spending are unlikely to abate anytime soon. As such, we look for continued modest gains for spending through 2018 - circa 0.4% for headline sales in March, and 0.2% for core

Preview via Nomura:

We expect a healthy 0.5% increase in core ("control") retail sales in March following a weak 0.1% increase in February.

- Strong consumer confidence and labor market conditions were likely supportive for consumer spending in March.

- In addition, the delayed arrival of tax refunds relative to historical precedents may have shifted spending in February to March. The BLS' seasonal adjustment process may not fully filter out this idiosyncratic change in spending pattern.

- However, recent divergence between elevated optimism and tame growth in personal spending, if continued, may increase the risk that personal spending does not respond to the recent personal tax cuts as strongly as we expected.

For non-core components, gasoline prices trended lower in March, pointing to a decline in nominal sales at gasoline stations.

- A transitory slowdown in construction sector hiring suggests that sales at building material stores, which tend to be volatile, may have declined notably. In addition, considering a sharp increase in auto sale figures reported by WardsAuto in March, sales at auto and auto parts dealerships likely increased solidly. Excluding autos and auto parts, we think retail sales remained flat in March. Put together, we expect a 0.2% increase in total retail sales for March.