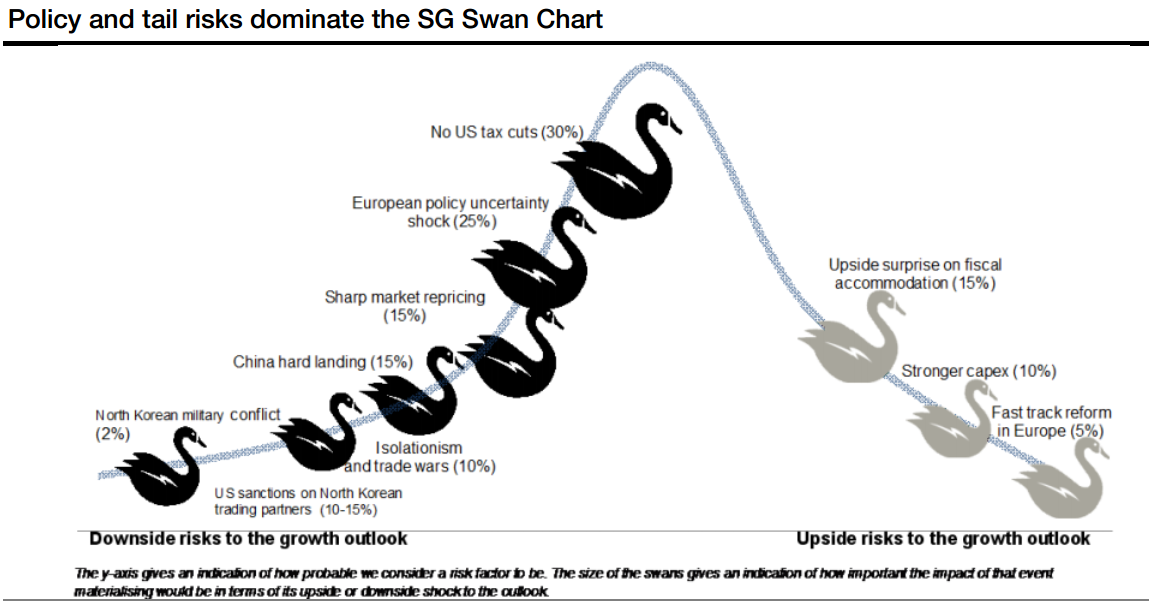

This is the latest Société Générale "Swan Chart" I've seen, a diagram of risks, both policy and tail risks:

I've posted these before, they are an attempt by SG to enumerate risk.

Says the bank on this one:

In addition to the growth slowdown embedded in our central scenario, significant systemic risks, not least geopolitical, subsist ...

- Tensions in the Korean peninsula have driven global investors to add safe-haven assets to their portfolio.

- In the US, aggressive rhetoric on protectionism and trade barriers could see global trade reverse course.

- In China, shadow banking and excessive levels of debt mean any policy mistake could see liquidity tensions arise and push the housing market through a severe correction.

SG obviously much ore concerned with the US tax debate than developments re North Korea .