Positioning matters

There's a couple of reasons to justify why the aussie and kiwi are deserving of a move higher today. Improved risk sentiment and better economic data being two of the obvious ones but does that warrant such rampant gains that we're seeing for the two currencies? Particularly against the dollar?

For me, when I see the moves in the currencies space so far today, this is what immediately springs to mind:

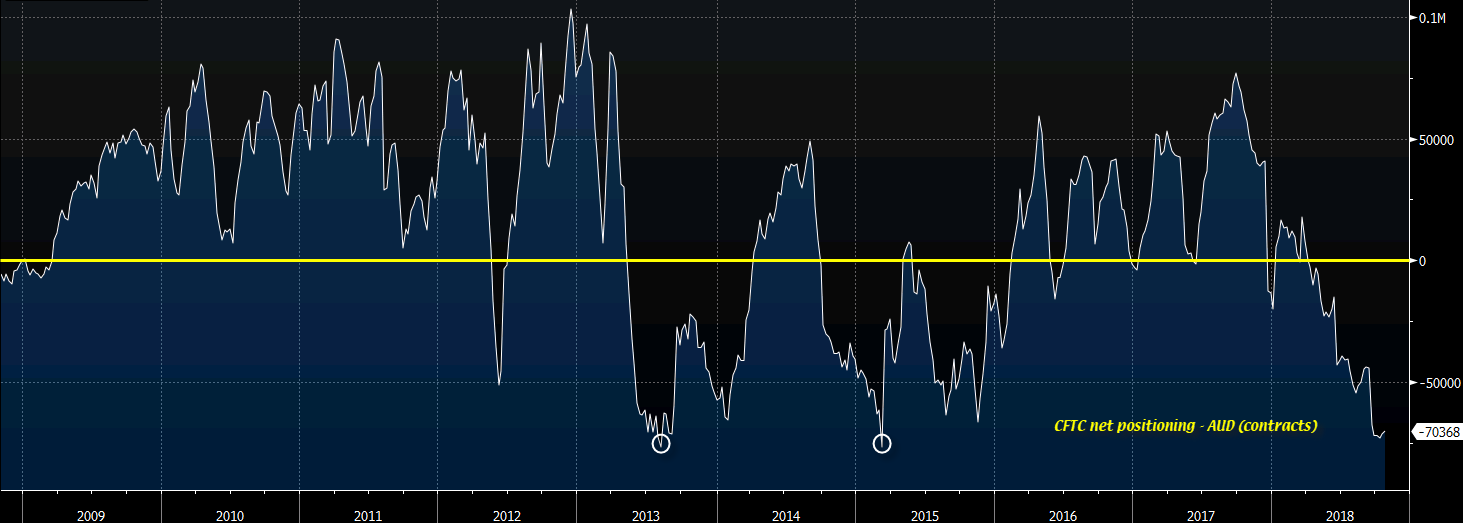

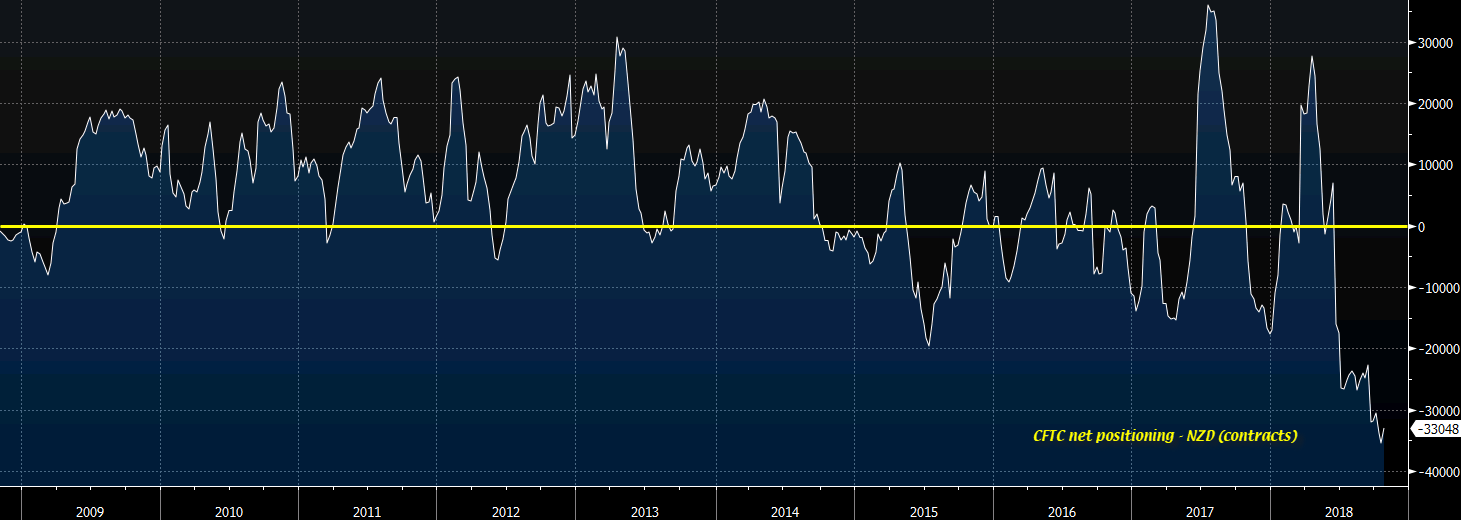

It's all about the squeeze. Aussie shorts are at its most stretched since 2015 while kiwi shorts are at their most stretched over the last ten years. When positions are this stretched, it doesn't take much for a correction or a short squeeze to happen.

The aussie has been plagued with negative news and poor risk sentiment since the start of the week, yet AUD/USD has failed to break below 0.7000. Then comes trade balance data today and that's enough to send the pair popping up back above 0.7100 dragging NZD/USD alongside it.

That's telling in the sense that it's not just data that's driving sentiment here but also that buyers are looking for a reason to hop back in/sellers looking to trim shorts. And it's a similar case for the pound as well:

Although shorts have been trimmed over the past few weeks, the positioning is still heavily skewed towards sellers at this point and that suggests that any squeeze to the upside on the back of positive Brexit headlines could have room to roam. Even more so, if those headlines have any solid backing to them.

If the UK and EU manage to move closer to a deal in the coming weeks, expect the pound to soar given such skewed positioning. As for the aussie and kiwi, I'm still of the view that there is nothing positive to be priced in for the two currencies but with selling looking to reach exhaustive levels (continuously failing to break below 0.7000 for AUD/USD), perhaps it's time to take a backseat until price action sorts itself out and/or positioning looks more "healthy".