Research from Danske:

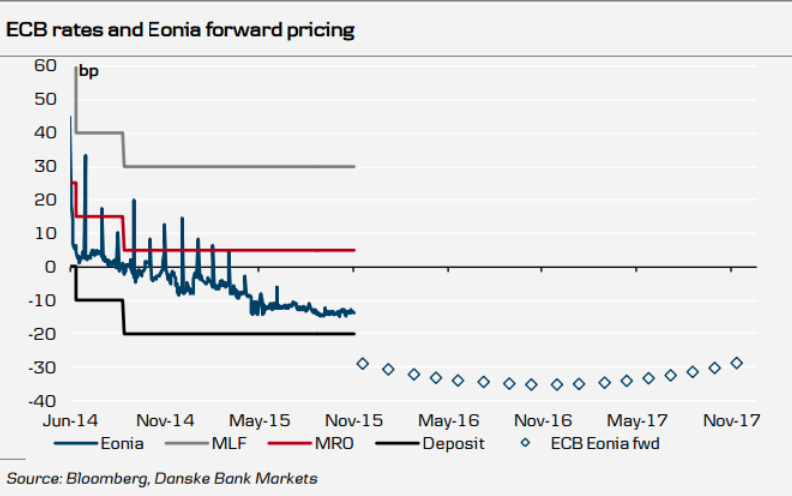

Wednesday's Reuters story has added to market expectations of an aggressive ECB move at the 3 December meeting. A roughly 16bp cut is now priced in for December and an accumulated 20bp cut is priced in 12M.

The Reuters story also included the interesting possibility of 'introducing a two-tier penalty charge on banks that park money with the ECB'. A 'two-tier deposit rate system' is already in place in both Denmark and Switzerland. In this document, we take a closer look at the lessons from the Danish system, as this could potentially have similar implications for the euro area, Eonia fixings and the swap curve.

The motivation behind a two-tier deposit rate system is to reduce the cost to the banking system. As long as banks are not willing to pass on the cost to the retail customer directly by introducing a negative deposit rate on retail deposits, cutting the ECB deposit rate further into the negative implies a higher cost for the banking system. A two-tier deposit rate scheme would reduce this cost, as some of the liquidity is placed at the 'higher deposit rate' but there are also potential negative effects from such a scheme. To illustrate, we take a look at the Danish set-up and experiences.

The Danish experience shows that it is definitely possible and it benefits the banking system. However, it could create negative side effects in terms of a higher spread between the overnight rate and the lowest deposit rate and larger volatility in fixings. In the DKK market, the uncertainty has been transferred into other short-term money-market rates.

For the EUR market, we would expect a smaller effect on the Eonia rate but it could result in a slightly higher spread to the lower deposit rate. However, as in Denmark, the key determinants would be (1) the spread between the two deposit rates, (2) the amount of excess liquidity and the fraction that can be placed at the two rates and (3) banks' willingness/ability to lend excess liquidity to each other (fragmentation).

For bank trade ideas, check out eFX Plus.