Via ING's outlook for the week ahead, strong words on what is weighing on the AUD

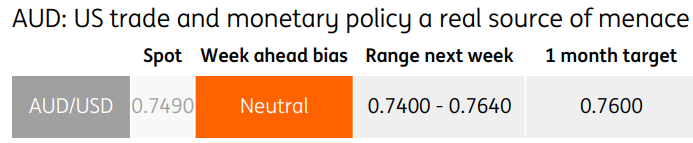

While a soft Australian jobs release has dented the Australian dollar, the real source of menace remains US policy.

- On the monetary side, higher short-term US rates continue to weigh on high-beta commodity currencies,

- while on the trade side, the follow-through of US tariffs on Chinese imports is a particular blow for the trade-sensitive AUD.

- In a quiet week for global markets, we suspect the latter will be the prevailing narrative - and this doesn't strike us a particularly conducive risk-taking backdrop.

The June RBA minutes (Tuesday) - as well as Governor Philip Lowe's participation at the ECB's Sintra conference (Wednesday) - are likely to be non-events for the AUD.

Look for the pair to remain contained in the 0.7400-0.7600 range in the absence of any further directional catalysts.