This will be preliminary economic growth data for the October - December quarter for Japan

- Due at 2350 GMT

What to expect and comparison with Q3:

- GDP (seasonally adjusted) for Q4, preliminary, q/q: expected 0.2%, prior 0.6%

- GDP Annualized (seasonally adjusted) for Q4, preliminary y/y: expected 1.0%, prior 2.5%

- GDP Nominal (seasonally adjusted) for Q4, preliminary q/q: expected 0.4%, prior 0.8%

- GDP Deflator y/y for Q4, preliminary: expected 0.0%, prior 0.1% (this is an indication to inflation, or lack of I guess)

- GDP Consumer Spending y/y for Q4, preliminary q/q, expected is 0.4%, prior was -0.5%

- GDP Business Spending y/y for Q4, preliminary q/q: expected 1.1%, prior was 1.1%

A preview posted yesterday (via Soc Gen):

While Japanese data does not usually tend to have too much of an immediate yen impact upon release, surprise strength will be taken as a yen positive. While the BOJ is still far from their inflation target, an improvement in the economy points to less need for monetary policy accommodation. Weakness, on the other hand, is a yen negative, it should indicate less need for alternation to the policy path.

More now in summary (bolding mine) via ...

Nomura:

First set of preliminary estimates for Q4 2017 real GDP (Wednesday): We expect Q4 (October-December) 2017 real GDP growth was 1.0% q-o-q annualized (0.2% q-o-q), which would be the eighth consecutive quarter of q-o-q growth.

Our overall view is that growth in private sector demand has been firm,

- while public sector demand has been on the weak side.

- We also believe external demand's contribution (which has boosted real GDP growth in many quarters up until the latest set of data) will likely be close to zero, with imports having shown particularly sharp growth.

As overseas economic conditions were quite healthy in Q4, we believe growth in exports from Japan was also likely quite strong. That said, imports rose sharply in December, with the result being that overseas demand's contribution (which has boosted real GDP growth in many quarters) was likely somewhere close to zero.

We estimate that private sector demand was generally quite brisk in Q4 2017.

- Consumer spending proved quite weak during summer, but there appears to have been a rebound in Q4, most notably in services-related spending.

We also expect capex to have risen.

Construction investment looks to have been sluggish, but we believe firm exports likely boosted machinery investment.

Meanwhile, we estimate that public sector demand was quite sluggish.

- Public investment grew sharply in H1 2017 on the execution of the second FY16 supplementary budget, but with these already having run their course, we expect there to have been a decline in Q4 (following on from a similar fall in Q3).

Core statistics also suggest that private sector housing investment continues to trend on the weak side, and we expect there to have been another q-o-q decline in this category.

While we expect there to have been positive growth for an eighth-straight quarter overall, growth is likely to be more moderate in Q4 compared with previous quarters which had exceeded the potential growth rate.

-

Barclays:

- We expect real GDP growth of 0.9% q/q saar - slower than in Q3, but in line with the upper level of estimated potential (0.5-0.8%) on support from domestic private-sector demand.

-

Pantheon Economics:

Japan's services sector rebounded in Q4, but real GDP growth likely slowed sharply

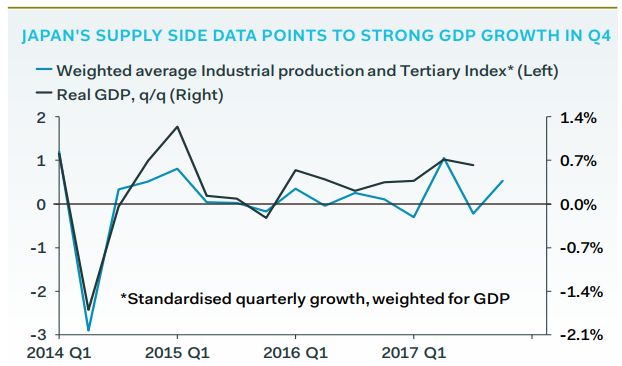

Supply-side indicators rebounded strongly in Q4 in Japan. The tertiary index fell by 0.2% month-on-month in December, but mainly as a correction after the sharp 1.1% rise in November. The index rose by 0.5% quarter-on-quarter in Q4, after the 0.2% decline in Q3.

Industrial production rose 1.7%, after Q3's 0.4% increase.

A weighted average of the two points to very solid GDP growth in Q4, but this measure undershot substantially in Q3, and is due to correct.

In addition, construction data were weak in Q4, though the subcomponent of the all-industry activity index began rising again in November.

Overall, demand-side growth points to a weak print for the preliminary estimate of Q4 GDP growth, at around 0.1%, down sharply from 0.6% in Q3. We expect that to be revised up, however, and in any case, GDP growth should rebound in Q1

Long live cryptocurrencies? Five insights from the ASAC Fund