A Friday (April 20) report from JP Morgan with a look at currencies

In summary:

USD

has failed to rally in the past month, despite several potential triggers

- including a relative outperformance in surprise indices

- and a sharp drop in equity markets

Most dollar pairs were confined to rather narrow ranges for the past month

- FX implied vol ground back to range lows, despite a rise in geopolitical risk headlines

- broader decorrelation between FX and its traditional drivers (including rates and risk assets) has expanded even to a recent desensitization to macro cyclical surprises and forecast revisions

multitude of very important global and US idiosyncratic tail risks will likely persist for some time and will likely constrain risk-taking by FX market participants

- includes the supposed ongoing renegotiation of the US-China economic relationship under the threat of potentially very large tit-for-tat tariffs

- potential change in the Korean peninsula's geopolitical status quo

- threats to US political continuity

In addition, some confirmation (or rejection) that the global cyclical slowdown is indeed temporary should help return some directionality to the broad dollar

beneath all the uncertainty and noise, the baseline assumptions about the global macro backdrop have not changed much

- we continue to expect the broad dollar to eventually resume a broad if modest grind lower in the medium-term

- The baseline assumptions include a continuation of the broad synchronized above-trend global growth driving a shift into or continuation of early-cycle policy normalization across much of the rest of the world and that the US cycle remains unexceptional

- Meanwhile, several longer-term factors will likely persistently weigh on the broad dollar, including a trend-widening of the US twin deficits and ongoing incremental reserve diversification away from the dollar

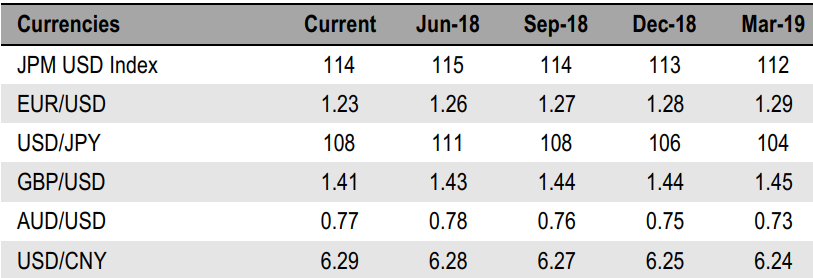

Forecasts:

JPM like long EUR/NZD