From Dr Shane Oliver, Head of Investment Strategy and Economics and Chief Economist at AMP Capital

The 'key points' he makes:

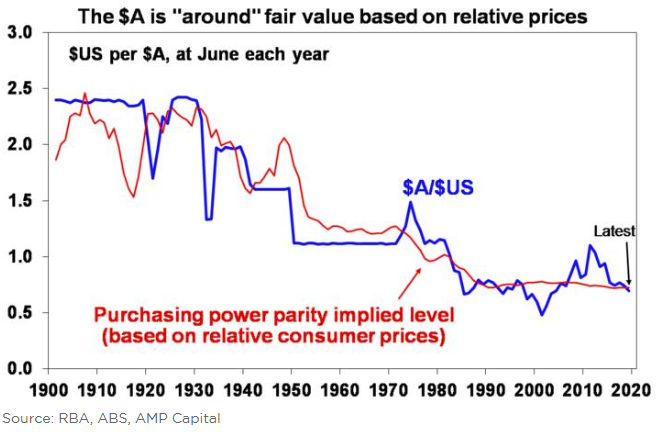

The Australian dollar likely faces more downside as Australian growth is weaker than US growth and the RBA is likely to cut more than the Fed.

- However, downside may be limited to around $US0.65 given that the $A has already had a large fall, short positions in the $A are large, the iron ore price remains high (for now) and the Fed is also heading towards rate cuts.

Given the downside risks for the $A and that being short the $A is a good hedge against threats to the global outlook it still makes sense for Australian investors to maintain a decent exposure to foreign currency via un-hedged global investments.