I posted earlier on Goldman Sachs warning on the dangers in the US stock markets:

Citi, too, this time via Bloomberg

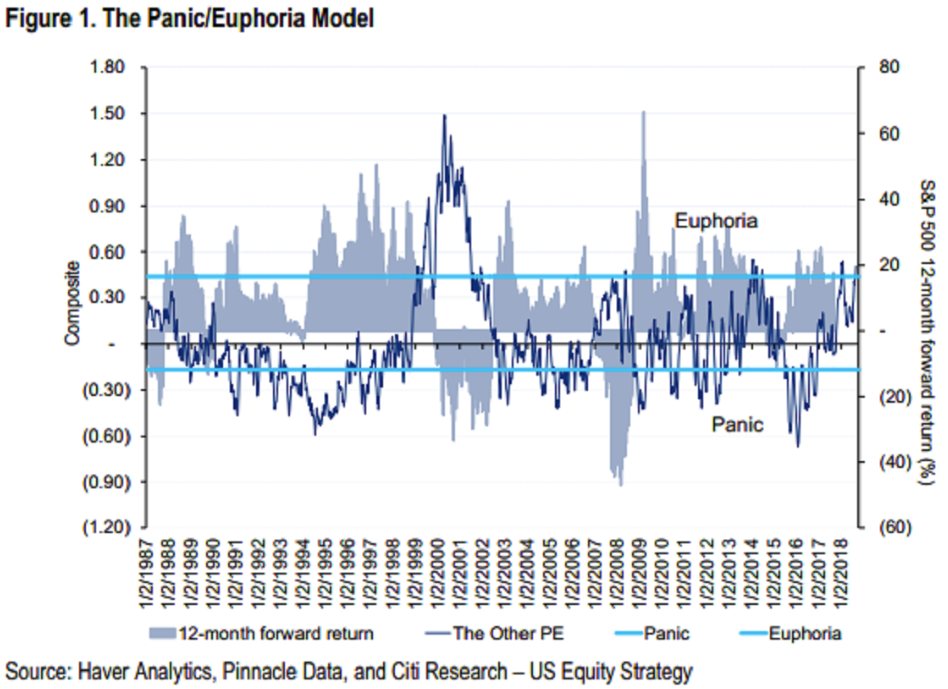

- panic/euphoria model, tracking everything from margin debt to options trading and newsletter bullishness, just showed sentiment climbed to extreme levels for the first time since January. Such readings have preceded equity losses over the following 12 months 70 percent of the time since 1987, more than three times the random probability.

Also, from others:

Deutsche Bank, predicted a retreat of 3 to 5 percent in September

- citing the month's poor seasonality

- and the prospects of more economic data missing expectations

- companies will likely provide little support with earnings season not starting until October and the buyback blackout period approaching

Morgan Stanley ... lowered their recommendation on U.S. equities

- citing the S&P 500's "extreme divergence" with other risky assets from the rest of world

- peaking profit growth

- and a slew of risk events over the next two months, including Fed meetings and U.S. midterm elections