Just the timing that's unclear

The odds of another US recession are 100%; it's just the timing that is unclear, writes BNP Paribas in a note to clients today.

"Clients often ask us the probability of another US recession. We generally answer "100%", but fight giving a precise timing. The fear of recession is one reason the Fed has been so cautious in normalizing its interest rates. Paradoxically, the long wait may have actually increased the probability of another recession in the next few years," BNPP clarifies.

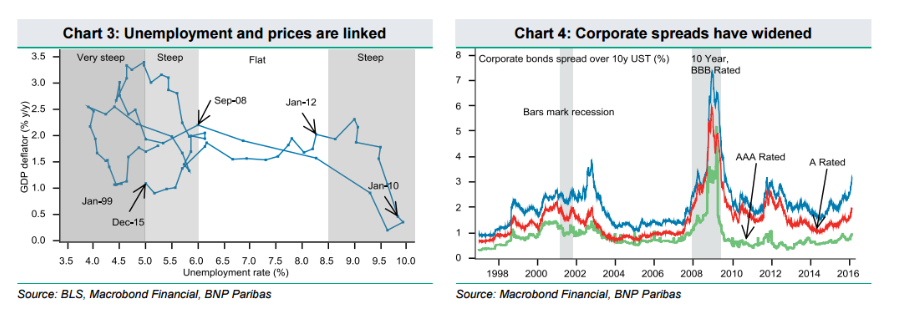

"We expect the Fed to see this and so our expectation is that, after an initial period of denial, in the event of recessionary forces the Fed is likely to quickly move to negative rates, adopt strong forward guidance and also implement another round of QE. Unfortunately, this limited ammunition is unlikely to be enough. More active fiscal policy may have to be the ship that comes to the rescue, which could take some time to be implemented. Despite near-zero growth in Q4 2015, we think a recession is coming, but probably not now. The widening in corporate spreads, beyond the energy sector, has us worried. The global economy is on fragile footing and, with a loss in confidence that US corporate borrowers can pay back their debts, what's already bad now is likely to get a lot worse," BNPP argues.

"We are also concerned that stricter regulatory regimes and a reduction in the capacity of genuine market makers to warehouse financial assets will make for a more-pronounced market reaction to the recession. Banks may also be quick to pull in lines of credit. This risks more market disruption, threatens the ability of firms to raise capital and probably forewarns a larger effect on the real economy. Firms will have to cut capex and jobs quickly, and declining household wealth is likely to crimp consumption, as will job losses. And imagine the effect of a US recession on an enfeebled global economy, particularly on emerging markets. Especially if the USD falls, as is likely, it will present challenges to the euro area and Japan, where policies are currently reliant on cheap currencies. It won't be pretty," BNPP adds.

BNPP thinks the next US recession will probably be longer than is typical, where the average is a four-to-five quarter contraction. A longer recession, according to BNPP, would be likely for a few reasons:

1- The Fed has little ammunition to combat a recession - during the last recession the fed funds rate was 5.25% before the first 50bp cut. While negative real rates are our central scenario in the event of another recession, the cut in rates will have to be much smaller than historically and so the stimulus will be much less;

2- The shock and awe created by QE1 will be lacking - no one in the markets believes in the power of QE to the same extent as when Bernanke first introduced it;

3- Core inflation is lower than prior to previous recessions, meaning deflation risks are larger, with more corrosive effects on activity;

4- Fiscal policy makers appear very reluctant to pass fiscal stimulus, particularly the size of a package necessary to offset a drop in GDP;

5- With investors still licking their wounds from the last crisis, it's unlikely that confidence will be restored very quickly;

6- While US housing does not have the sub-prime distortions of 2007, house prices in relation to incomes are high and could suffer more than most reckon.

7- The global economy looks weaker and there is less room for the sort of stimulatory policy we saw after the GFC (eg, in China).

For bank trade ideas, check out eFX Plus.