Reserve Bank of New Zealand AG Hawkesby

- the August Monetary Policy Statement noted that we had more confidence that employment was at its maximum sustainable level and that pressures on capacity would feed through into more persistent inflation pressures over the medium-term.

The full text can be found through links at the RBNZ website here. Note that the speech was prepared for presentation at a conference which has been indefinitely postponed due to the current COVID outbreak. The text was finalised on 15 September.

For background to this, and why the RBNZ did not hike at its August meeting, check this out:

Headlines via Reuters:

- early discovery of vaccines against Covid-19 has supported a stronger-than-expected recovery in the global economy

- August monetary policy statement noted we had more confidence that employment was at its maximum sustainable level

- demand for our goods exports has fared much better than during previous global downturns

- also benefited from a robust recovery in the Chinese economy, our largest trading partner

- monetary and government spending policies have supported a strong recovery in spending.

- government's wage subsidy scheme is a policy that has been particularly effective in supporting the wider recovery

- business investment has also picked up as the economy has recovered

- looking ahead, we see the level of house prices as unsustainable relative to their fundamental drivers

- in August, committee agreed their "least regrets policy stance is to further reduce monetary stimulus to anchor inflation expectations"

- the disruption to the supply side of the economy has also been more prolonged than anticipated

- there have been significant disruptions to supply chains, particularly related to the shipping industry

- given emergence of transmissible variants of Covid-19, disruptions to movement of goods & people globally looks likely to continue over medium term

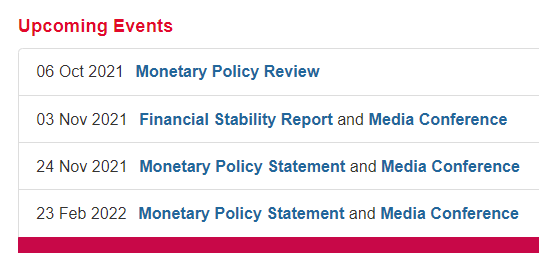

Upcoming RBNZ meetings:

More from Hawkesby:

- initial health measures were able to contain virus, with most households & businesses able to return to normal activities sooner than feared

- national level household incomes were largely maintained through covid-19 lockdown periods

- the recovery phase has also seen house prices grow rapidly from already elevated levels

- there has been stronger than expected domestic economy and associated improvement in job security

- Covid-19 has also made it more difficult for firms to source labour

- pressures on capacity would feed through into more persistent inflation pressures over the medium-term