Retail money continues to pile into the trade

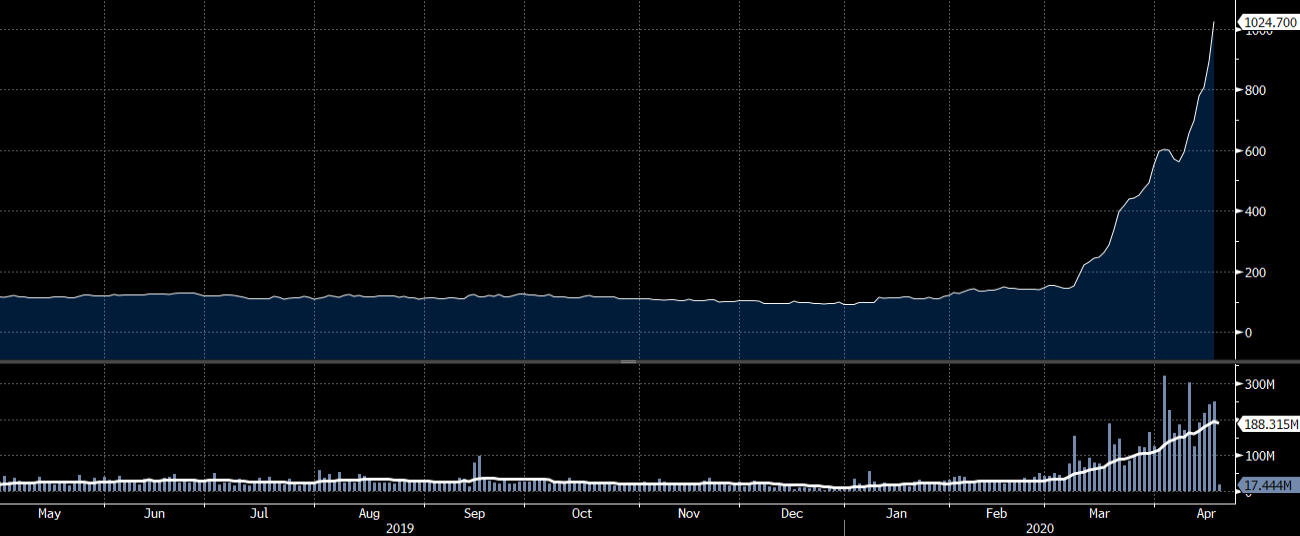

Hedge funds see a chart like this and absolutely lick their chops. It shows shares outstanding in USO, which is the main oil ETF.

Retail traders have absolutely piled into longs in crude oil, betting on a steeper curve while misunderstanding negative roll yield.

That alone is usually enough for a trade, because of retail's abysmal track record. What makes it particularly alluring is that the ETF now owns 146,542 contracts for the June expiration. That's 27.2% of the open interest in the contract, compared to less than 5% normally and they have another few % in pending trades.

Ultimately, these positions need to be sold, not just on the retail side but they will need to be rolled to July. Moreover, the ETF late on Thursday realized that it had a problem and changed its mandate to put 20% of open interest in the second-month contract (which is currently July). They appear to be doing that now and that's going to place additional pressure on the June contract.

I have been warning about this.