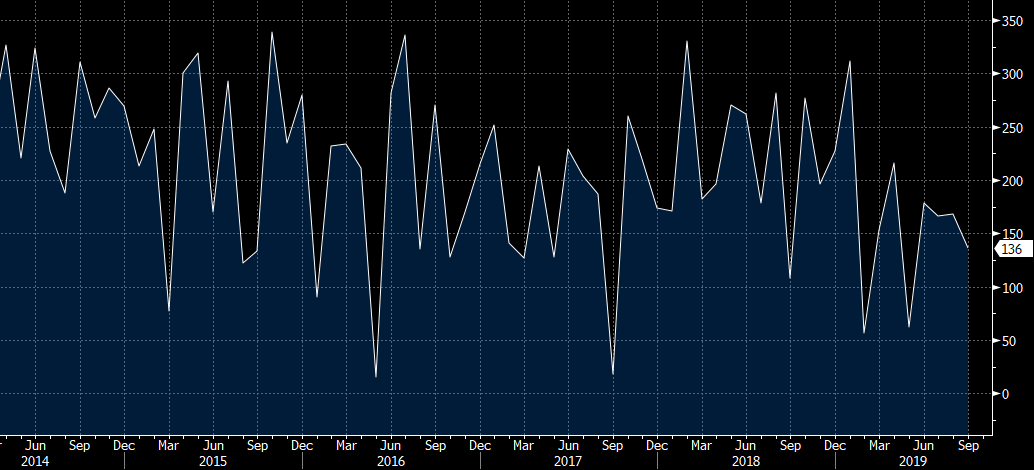

September 2019 US non-farm payrolls:

- Prior was +130K (revised to +168K)

- Estimates ranged from 85K to 185K

- Two month net revision +45K

- Unemployment rate 3.5% vs 3.7% expected (prior 3.7%) -- 50-year low

- Participation rate 63.2% vs 63.2% exp (63.2% prior)

- Avg hourly earnings 0.0% m/m vs +0.2% exp

- Avg hourly earnings 2.9% y/y vs +3.2% exp -- lowest since July 2018

- Prior avg hourly earnings 3.2%

- Avg weekly hours 34.4 vs 34.4 exp

- Private payrolls +114K vs +130K exp

- Manufacturing -2K vs +3K expected

- U6 underemployment 6.9% vs 7.2% prior

- Temporary census hiring totaled 1K

This is a great report for risk assets and solid for the US dollar. The number was close to expectations but wage data was soft, suggesting slower inflation.

The combination of the headline and revisions shows that the economy is in fine shape and the drop in unemployment is positive.

The kneejerk reaction has seen USD/JPY up to 107.00 from 106.75.