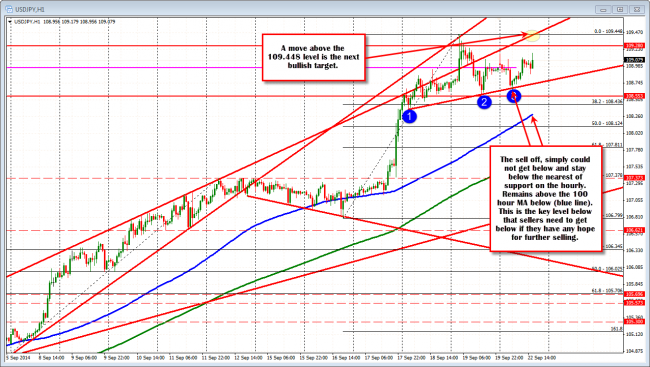

The USDJPY tried to extend back lower in trading today but momentum could not be maintained. Putting it another way, the sellers had the opportunity, but they could not even do the minimum.

Technical Analysis: USDJPY sellers cannot do the minimum. Buyers remain more in control.

The low for the day bottomed near bottom trend line connecting the lows from Thursday and Friday on the hourly chart above. The failure to do the minimum (get below this line) is a disappointment.

The price recently made new highs for the day, taking out the high price at 107.17 made in the first hour of trading – but only by a pip (so far). The range for the day is 52 pips from low to high. The average over the last 22 trading days (a month worth of trading) is 63 pips. So there is room to roam a little still, just to get to the average. The Existing Home Sales data at 10 AM ET, will be eyed for a fundamental clue.

The high from last week is the next upside target for the buyers. Get above and it opens the door toward the 110.00 and then the 110.67 (high price from 2008).

On the downside, the aforementioned trend line along with the 100 hour MA will be eyed for bearish clues. If the pair cannot get below these levels, what is it selling about the sellers? That they are not that strong is what it says to me.