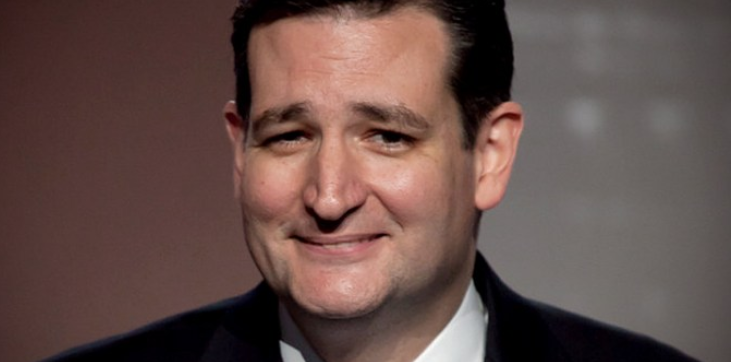

Senator Ted Cruz wants bigger tax cut

Ted Cruz was one of the biggest deficit hawks in Washington, until today.

He just came out and said the tax plan shouldn't be revenue neutral, which is another way of paying it shouldn't pay for itself. Instead, he wants to run bigger deficits in order to pay for it.

Unless Trump can get 60 cotes in the Senate, Congress can only pass a tax cut for 10 years. Otherwise, it need to be revenue neutral.

That's something that the Ted Cruz-who-votes-against-raising the-debt-ceiling-every-single-time would support. But this Ted Cruz is different. He wants a 15-20% corporate tax and doesn't care if it makes the deficit larger.

Now this is probably just a ruse to distract from his embarrassing Twitter gaffe overnight but it's indicative of the way things are going in Washington and in global politics more generally.

I think this is the future. The US government can borrow for 30 years at 2.78%. Australia just announced 100-year bonds.

Debt doesn't matter. Deficits don't matter.

Japan's debt-to-GDP is more than triple what it is in the United States and it can borrow for 0.83% for 30-years.

Quantitative easing has sterilized debt while automation and offshoring have slayed inflation. It's the perfect time to run enormous deficits that create growth. Whether that's though spending or tax cuts is the only question.