This is worse than colluding with Russia; Trump is a Dow Man

Wall Street is a soulless, ethically bankrupt cesspool but everything can be forgiven if you can make money. Yet there is one type of man who traders will never forgive: The Dow Man.

Quoting the Dow Jones Industrial Average is the mark of a pure amateur, someone who shouldn't be talking about the market at all -- a dabbler. If a recruit mentions the Dow in a job interview, end the call.

It's a useless relic -- a narrow, price-weighted index. It tracks 30 companies, which is no way to look at the biggest economy in the world. They're added and subtracted habitually and only a few are 'industrial'.

All that could be forgiven, I suppose, but it's mortal sin is price weighting. That means whatever company has the highest share price counts for the most. So because Goldman Sachs trades at $227, it has a vastly larger impact on the index than General Electric at $25 per share even though GE is a much bigger company by any measure. Goldman's weight in the index is 6.96%, GE's is 0.80%.

The only reason to create a price-weighted index is because it's easy to do with only a pencil and paper. And that's exactly why it was invented in 1885 and why it made for a decent index for the next 80 years.

Even as a way to see the historical longview it's a sham. Just 4 companies remain from the 1975 index, which is the year it should have been abandoned for the S&P 500.

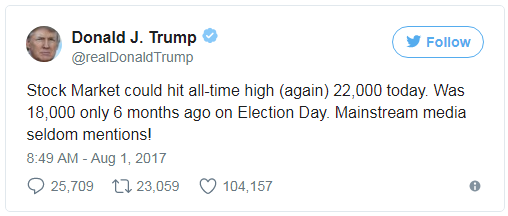

That brings us to the President. When he talks about the stock market, unfortunately, he talks about the DJIA.

That the mainstream media mentions the DJIA at all is a testament to how out of touch media is with the real world. A Dow Man is equally out of touch, and that's a terrible thing for a President to be, let alone a billionaire New Yorker.

Please, Mr. President, start using a broad, market-cap weighted index like the S&P 500 when you talk about 'the stock market'.

Then maybe we can talk about the metric system.