A litter more from the BofAML June Global Fund Manager Survey, this time on the US dollar.

This snippet :

- long US Treasuries becomes #1 "crowded trade"

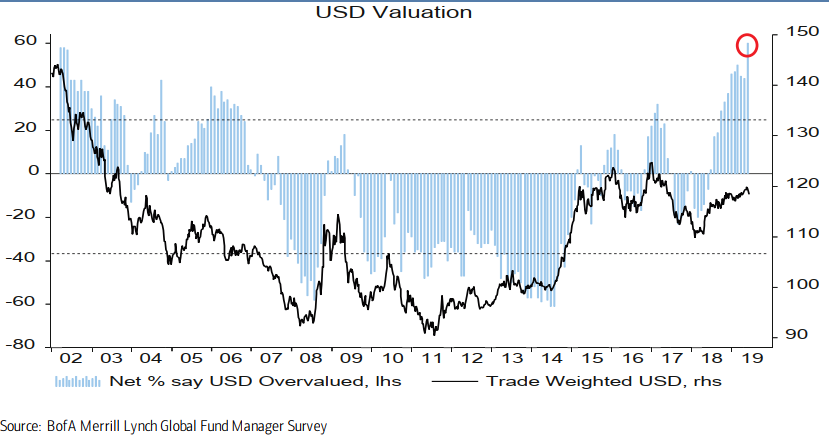

- US dollar "overvaluation" highest since 2002

While long USTs is the most crowded Boa ML note the level of overvaluation of the USD

- Record 60% of FMS investors say US dollar overvalued, up 16ppt m/m

- Current valuation is 2.1 stdev above the long-term average

Added bonus ….. the bank note that EUR valuation near 17-year low

- Net 29% FMS investors say EUR is cheap, up 3ppt from last month which was in line with lowest since May'17 & a 17-year low.

- Current valuations are 1.8 stdev below the longterm average.