UK BBA May mortgage data 26 June

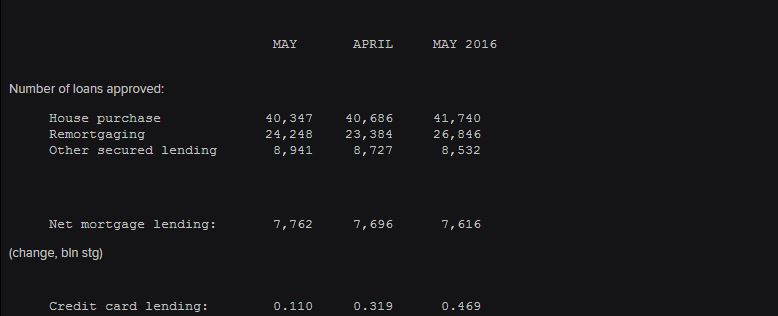

- 40.686k prev down from 40.75k

- -3.3% yy

- net mortgage lending GBP +1.767bln vs 1.528bln prev

- credit card lending £110m vs 319m prev

- net lending to non-financials £23m vs -587m prev

- consumer credit 5.1% vs 6.4% prev

Seems like household debt still building but notes of caution as rate slows to levels not seen since 2015

Says the BBA:

"This month's figures show that in the run up to the General Election, credit growth in personal loans, cards and overdrafts has slowed, which was reflected in lower spending; with increased household costs affecting growth in deposits and saving.

Businesses appear to be weighing up their options before raising finance to fund projects or developments. After a long period of subdued company borrowing, overall growth is starting to stabilise at a modest rate."

Full report here

GBPUSD back up testing 1.2750 after the retreat into 1.2720 as EURGBP heads lower to 0.8772