Latest data released by ONS - 18 July 2019

- Prior -0.5%; revised to -0.6%

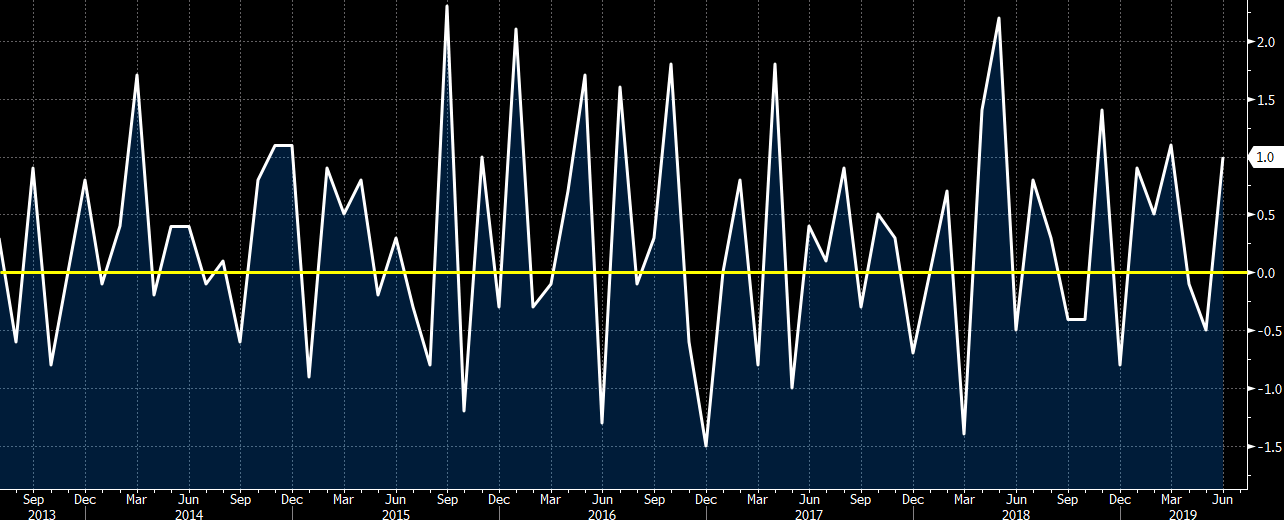

- Retail sales +3.8% vs +2.6% y/y expected

- Prior +2.3%; revised to +2.2%

- Retail sales (ex autos, fuel) +0.9% vs -0.2% m/m expected

- Prior -0.3%; revised to -0.4%

- Retail sales (ex autos, fuel) +3.6% vs +2.6% y/y expected

- Prior +2.2%; revised to +2.0%

That is a solid beat and allows the pound to stretch its gains further a little with cable rising to a high of 1.2484 from 1.2470 levels earlier. Looking at the details, ONS notes that the bounce in retail sales in June came on the back of growth in non-food stores and a surprise increase in sales of second-hand goods.

Further details weren't so convincing with food stores sales falling for the first time this year and department store sales continuing to decline in Q2 as a trend.

It still is a good report on paper though even with the niggling parts pointed out above but it will do little to shift the dial in the BOE and Brexit sentiment. If anything, this should at least help to keep the pound firm on the session after the move higher before the release.

But just be wary that cable is closing in on key near-term resistance levels so sellers may look to lean on those levels to regain control. Similar for EUR/GBP as price closes back in on the 0.9000 handle.